In a world when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. For educational purposes in creative or artistic projects, or simply to add an individual touch to the space, Income Tax Exemption For Housing Loan Under Construction are a great source. Here, we'll dive into the sphere of "Income Tax Exemption For Housing Loan Under Construction," exploring their purpose, where you can find them, and how they can enhance various aspects of your lives.

Get Latest Income Tax Exemption For Housing Loan Under Construction Below

Income Tax Exemption For Housing Loan Under Construction

Income Tax Exemption For Housing Loan Under Construction - Income Tax Exemption For Housing Loan Under Construction, Income Tax Exemption For Home Loan Under Construction, Tax Exemption For House Loan Which Is Under Construction, Housing Loan Tax Exemption In India, Under Construction Home Loan Tax Benefits India, Is Home Loan Exempted From Income Tax

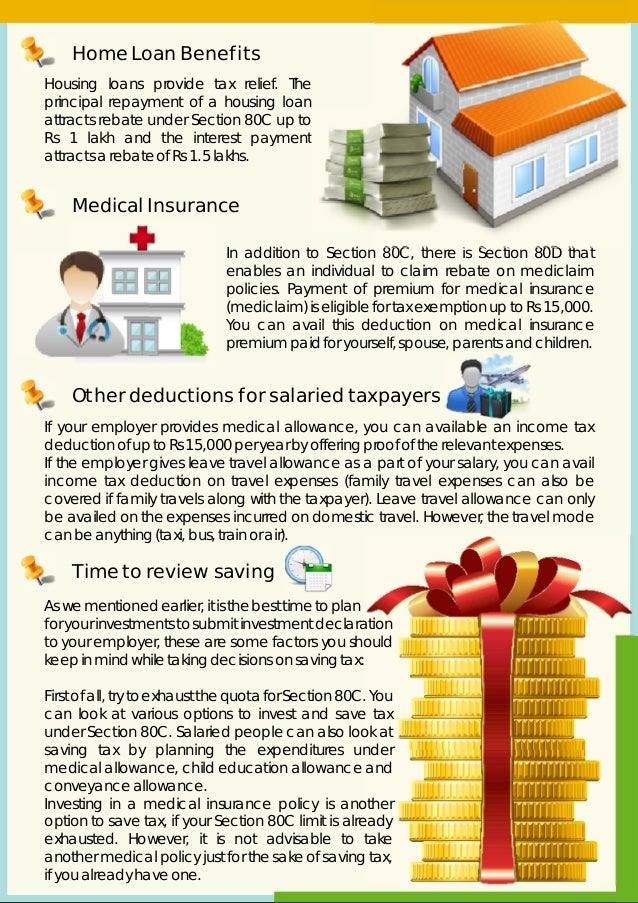

Section 24 b of the Income Tax Act 1961 allows you to claim deductions on the payments made towards the interest component of a Home Loan If the loan is availed of to

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs 30 000

Income Tax Exemption For Housing Loan Under Construction provide a diverse assortment of printable, downloadable materials available online at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Income Tax Exemption For Housing Loan Under Construction

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

Section 80EE of the Income Tax Act offers an extra under construction property tax benefit of Rs 50 000 per financial year on home loan interest rates if the provided limit of Rs 2 Lakh under Section 24B has been

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: There is the possibility of tailoring printing templates to your own specific requirements such as designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them an essential resource for educators and parents.

-

An easy way to access HTML0: The instant accessibility to an array of designs and templates saves time and effort.

Where to Find more Income Tax Exemption For Housing Loan Under Construction

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Check out the Home Loan tax benefits under Sections 24 b 80EE and 80C to save tax on your Home Loan Learn how much tax exemption you can claim on a housing loan

If you are paying EMI for the housing loan it has two components interest payment and principal repayment The interest portion of the EMI paid for the year can be

Since we've got your interest in Income Tax Exemption For Housing Loan Under Construction Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Income Tax Exemption For Housing Loan Under Construction for a variety reasons.

- Explore categories such as furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free, flashcards, and learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing Income Tax Exemption For Housing Loan Under Construction

Here are some new ways for you to get the best use of Income Tax Exemption For Housing Loan Under Construction:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Exemption For Housing Loan Under Construction are an abundance with useful and creative ideas for a variety of needs and desires. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the many options of Income Tax Exemption For Housing Loan Under Construction and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can print and download these documents for free.

-

Can I use free printables for commercial purposes?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions on their use. Be sure to review the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in the local print shops for superior prints.

-

What software do I need in order to open printables at no cost?

- Many printables are offered in the format of PDF, which can be opened with free programs like Adobe Reader.

Home Loan Interest Exemption In Income Tax Home Sweet Home

Income Tax Exemption U s 80EEA Interest On Affordable Housing Loan

Check more sample of Income Tax Exemption For Housing Loan Under Construction below

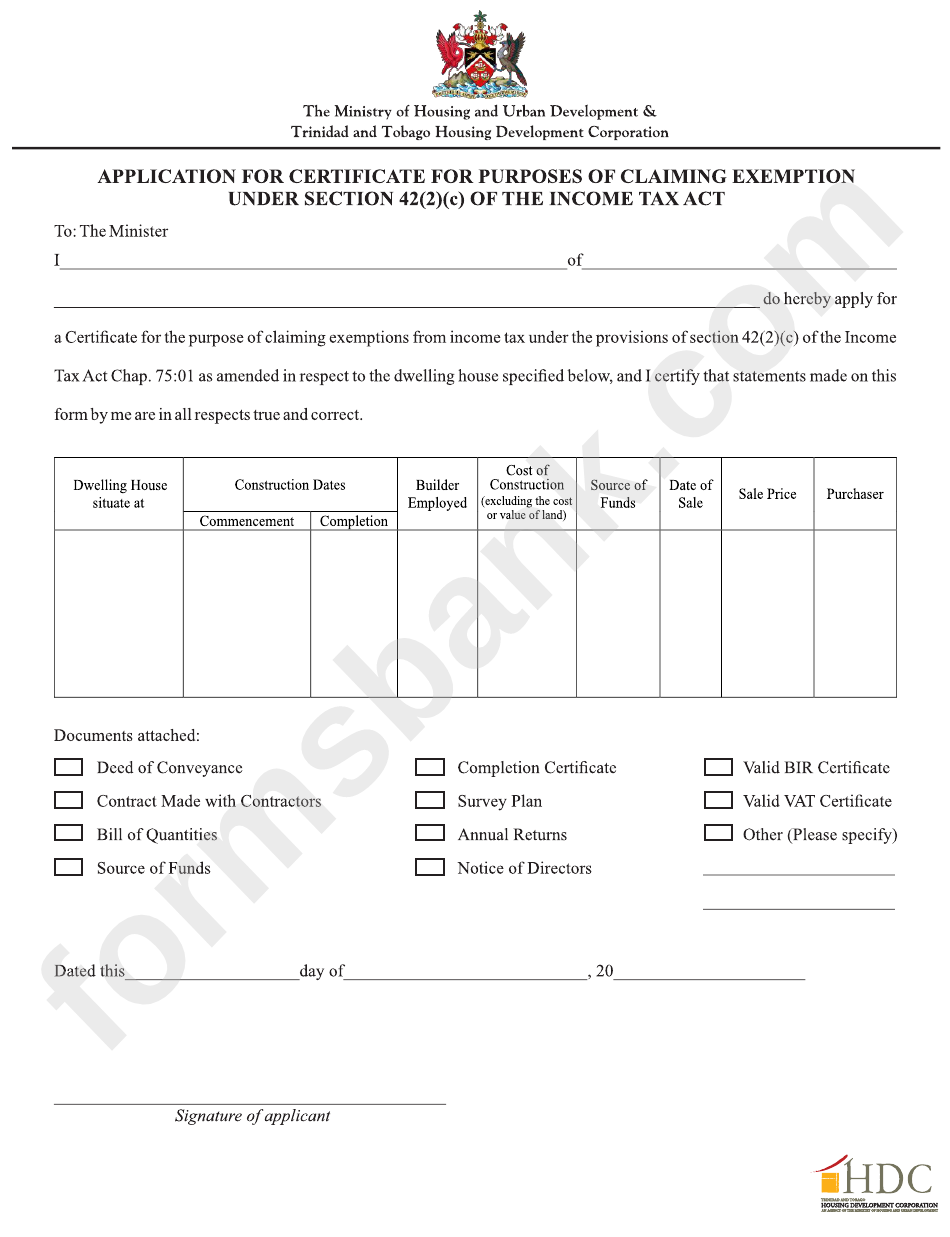

Application For Certificate For Purposes Of Claiming Exemption Under

How To Claim Home Loan Interest For Under Construction Property

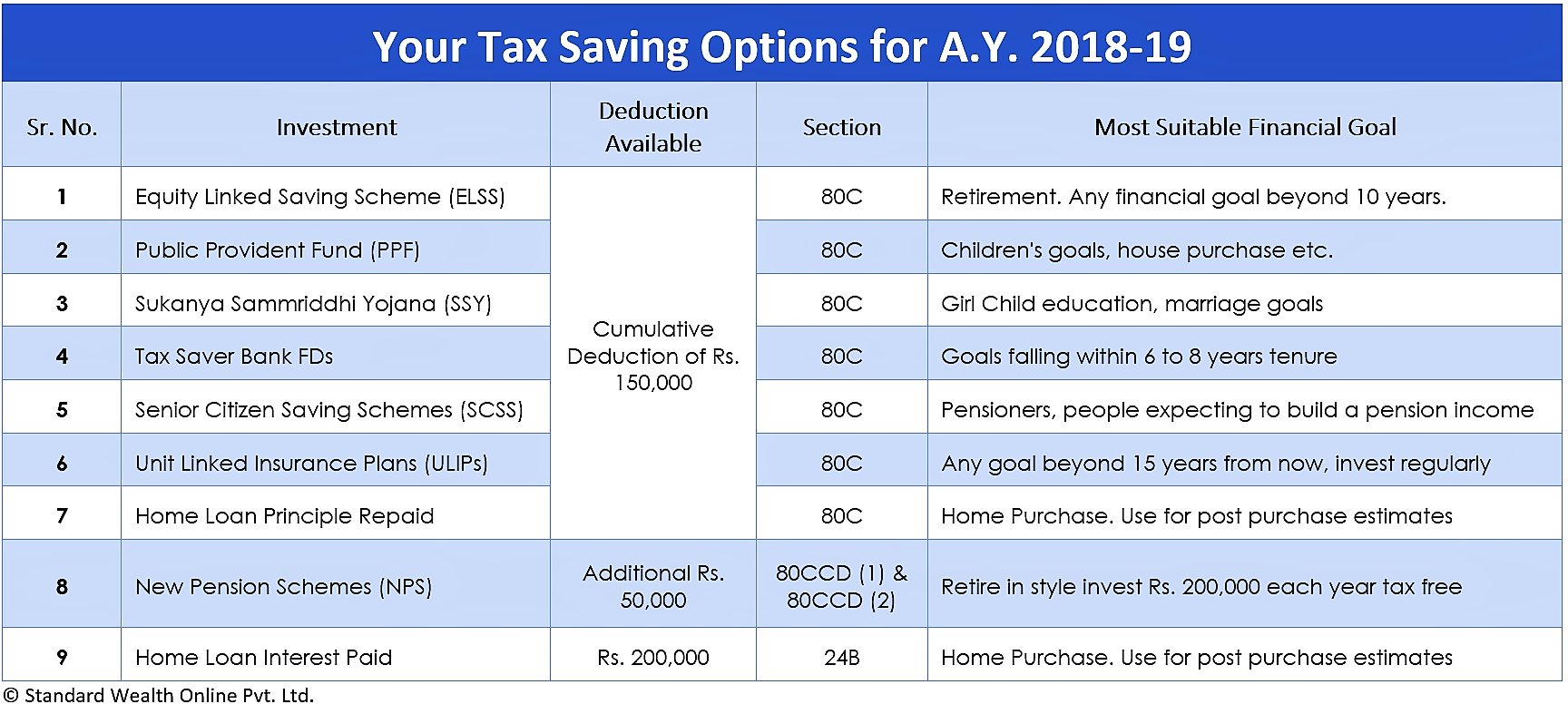

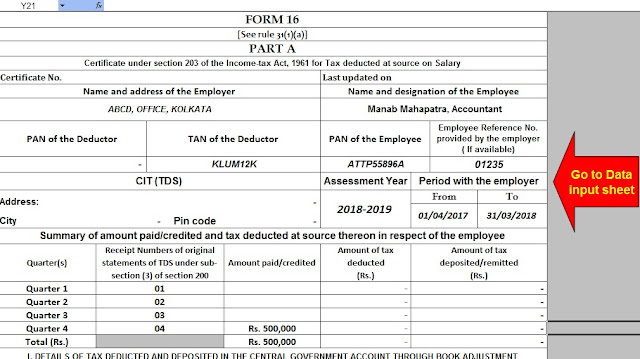

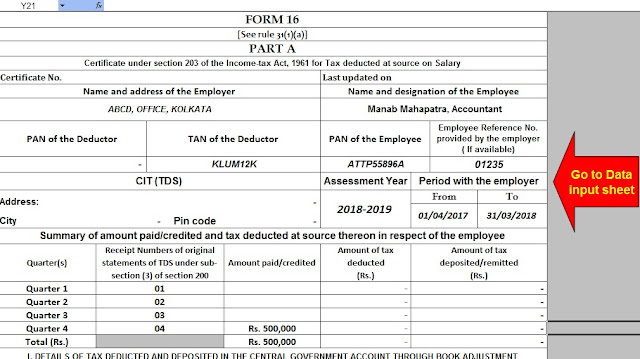

Housing Loan Tax Exemption Fy 2018 19 Tax Walls

TIPS TO REMEMBER ABOUT HOME LOAN FOR UNDER CONSTRUCTION PROJECTS Home

How HRA Tax Exemption Is Calculated U s 10 13A Calculation Guide

Housing Loan Tax Exemption Fy 2018 19 Tax Walls

https://cleartax.in › home-loan-tax-benefit

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs 30 000

https://tax2win.in › guide › under-construction-property-tax-benefit

As per the Income Tax Act of 1961 Section 24B homeowners are qualified for a tax deduction of up to 2 lakh per financial year on the interest paid for a home loan used for

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs 30 000

As per the Income Tax Act of 1961 Section 24B homeowners are qualified for a tax deduction of up to 2 lakh per financial year on the interest paid for a home loan used for

TIPS TO REMEMBER ABOUT HOME LOAN FOR UNDER CONSTRUCTION PROJECTS Home

How To Claim Home Loan Interest For Under Construction Property

How HRA Tax Exemption Is Calculated U s 10 13A Calculation Guide

Housing Loan Tax Exemption Fy 2018 19 Tax Walls

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Can You Take A Home Loan And Also Claim LTCG Tax Exemption