Today, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. If it's to aid in education project ideas, artistic or simply adding an individual touch to the home, printables for free are now an essential source. Through this post, we'll take a dive to the depths of "Income Tax Exemption On Interest Income For Senior Citizens," exploring the benefits of them, where they are, and how they can add value to various aspects of your daily life.

Get Latest Income Tax Exemption On Interest Income For Senior Citizens Below

Income Tax Exemption On Interest Income For Senior Citizens

Income Tax Exemption On Interest Income For Senior Citizens - Income Tax Exemption On Interest Income For Senior Citizens, Income Tax Rebate On Interest Income For Senior Citizens, Income Tax Exemption On Fixed Deposit Interest For Senior Citizens, Exemption Of Interest Income For Senior Citizens, How Much Interest Income Is Tax Free For Senior Citizens, Interest Exemption Limit For Senior Citizens, What Is The Exemption Limit For Interest Income

Note As per the Interim Union Budget FY 2023 24 no changes have been made to the tax slabs for senior citizens and super senior citizens for AY 2024 25 Income Tax Slab for Senior Citizens The tax slabs for senior citizens for FY 2023 24 are as follows Up to Rs 3 00 000 No Tax From 3 00 001 to 5 00 000 5

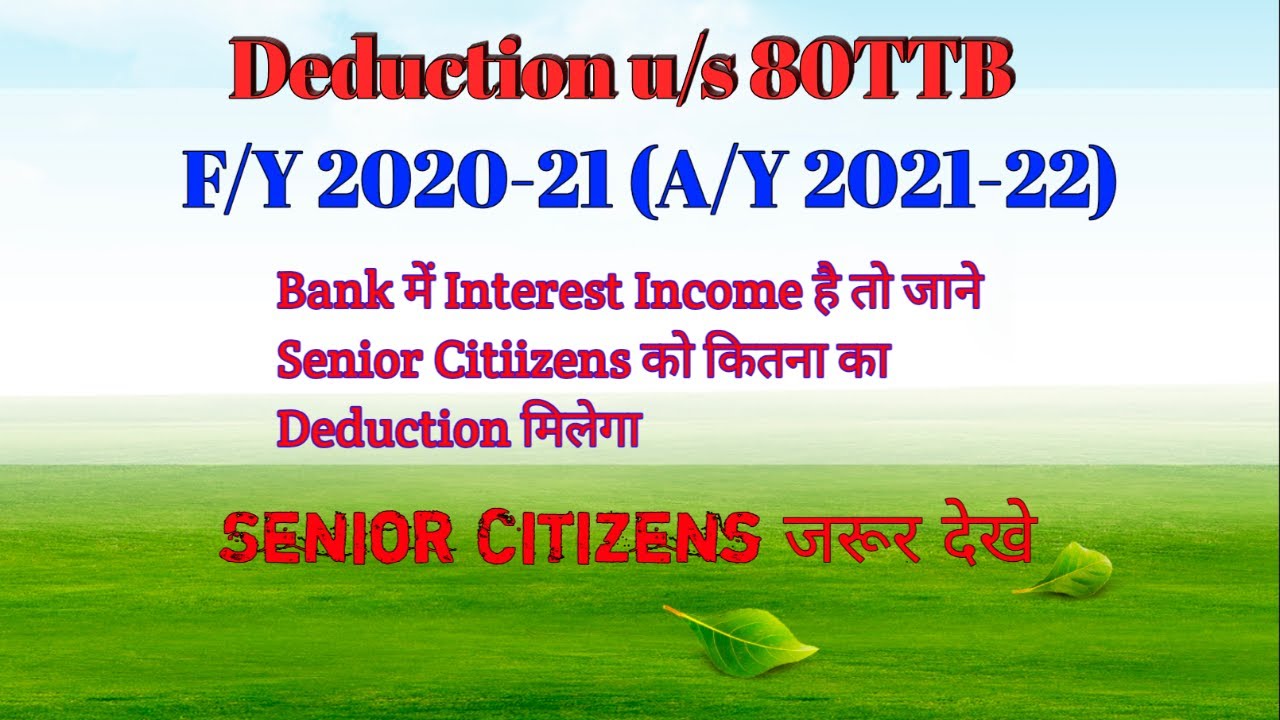

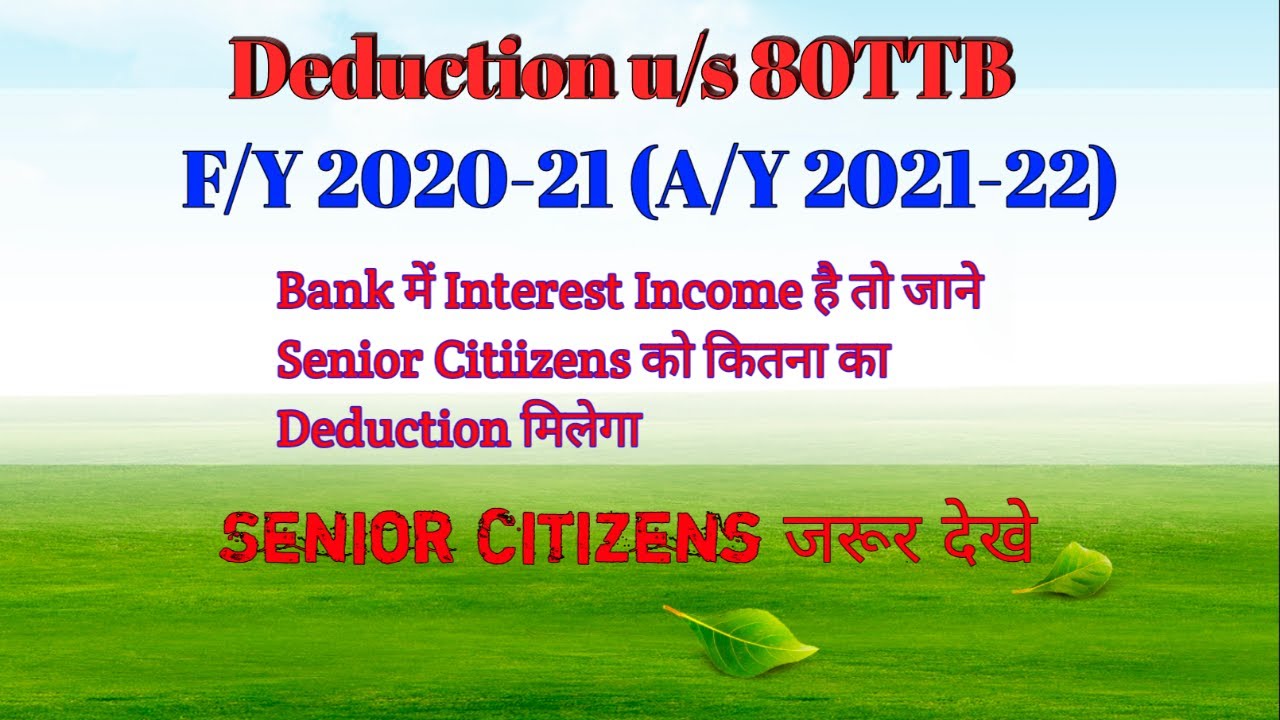

Government introduced Section 80TTB in Finance Budget 2018 to provide tax deductions for senior citizens on bank deposits interest Senior citizens can claim up to Rs 50 000 deduction from gross total income The section is effective from April 1 2018 and applicable to residents aged 60 and above There are exceptions for specific deposit

Income Tax Exemption On Interest Income For Senior Citizens cover a large selection of printable and downloadable materials that are accessible online for free cost. They are available in numerous formats, such as worksheets, coloring pages, templates and much more. The appeal of printables for free is their flexibility and accessibility.

More of Income Tax Exemption On Interest Income For Senior Citizens

Form 15H Amended Senior Citizens To Get Higher TDS Exemption On

Form 15H Amended Senior Citizens To Get Higher TDS Exemption On

Enter any tax exempt interest income such as interest on municipal bonds plus any exclusions from income for Interest from qualified U S savings bonds Employer provided adoption benefits

Section 80TTB of the Income Tax Act provides tax benefits for senior citizens on interest income from deposits allowing a deduction of Rs 50 000 on deposits from the Post Office Bank and

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor printables to your specific needs for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational value: These Income Tax Exemption On Interest Income For Senior Citizens cater to learners from all ages, making them an essential instrument for parents and teachers.

-

Convenience: immediate access a variety of designs and templates reduces time and effort.

Where to Find more Income Tax Exemption On Interest Income For Senior Citizens

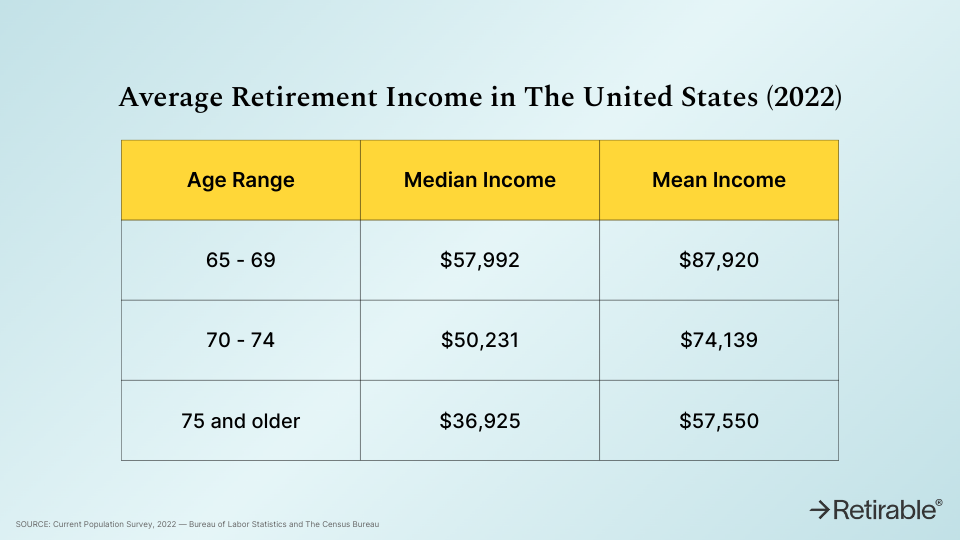

Average Retirement Income 2023 How Do You Compare

Average Retirement Income 2023 How Do You Compare

Section 80TTB of the Income Tax Act presents senior citizens with advantageous tax benefits concerning the interest income garnered from various deposits Enacted as part of the Finance Budget 2018 this provision aimed at senior citizens offers a new avenue for tax relief Given that interest up to Rs50 000 under Section 80TTB

Section 80TTB of the Income Tax Act 1961 allows a resident senior citizen to claim a deduction against interest on the deposit Section 80TTB is popular for claiming deduction against interest income on a fixed deposit and savings account balance

We hope we've stimulated your interest in Income Tax Exemption On Interest Income For Senior Citizens we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Income Tax Exemption On Interest Income For Senior Citizens for different goals.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad range of interests, from DIY projects to party planning.

Maximizing Income Tax Exemption On Interest Income For Senior Citizens

Here are some innovative ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Exemption On Interest Income For Senior Citizens are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and needs and. Their availability and versatility make them a fantastic addition to the professional and personal lives of both. Explore the many options of Income Tax Exemption On Interest Income For Senior Citizens and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I make use of free printables for commercial uses?

- It's dependent on the particular rules of usage. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download Income Tax Exemption On Interest Income For Senior Citizens?

- Certain printables may be subject to restrictions concerning their use. Check the terms and conditions offered by the author.

-

How can I print printables for free?

- Print them at home with the printer, or go to the local print shop for superior prints.

-

What software will I need to access printables at no cost?

- The majority of printed documents are in the format PDF. This can be opened using free software such as Adobe Reader.

What Is Considered Low Income For Senior Citizens GoodLife 2022

Income Tax Exemption Big News Senior Citizens Can Avoid Paying 10

Check more sample of Income Tax Exemption On Interest Income For Senior Citizens below

Gratuity Under Income Tax Act All You Need To Know

Section 80TTB AY 2021 22 Deduction On Interest Income For Senior

CBDT Notifies Income Tax Exemption On California Public Employees

Budget 2018 Exemption On Interest Income For Senior Citizens Hiked To

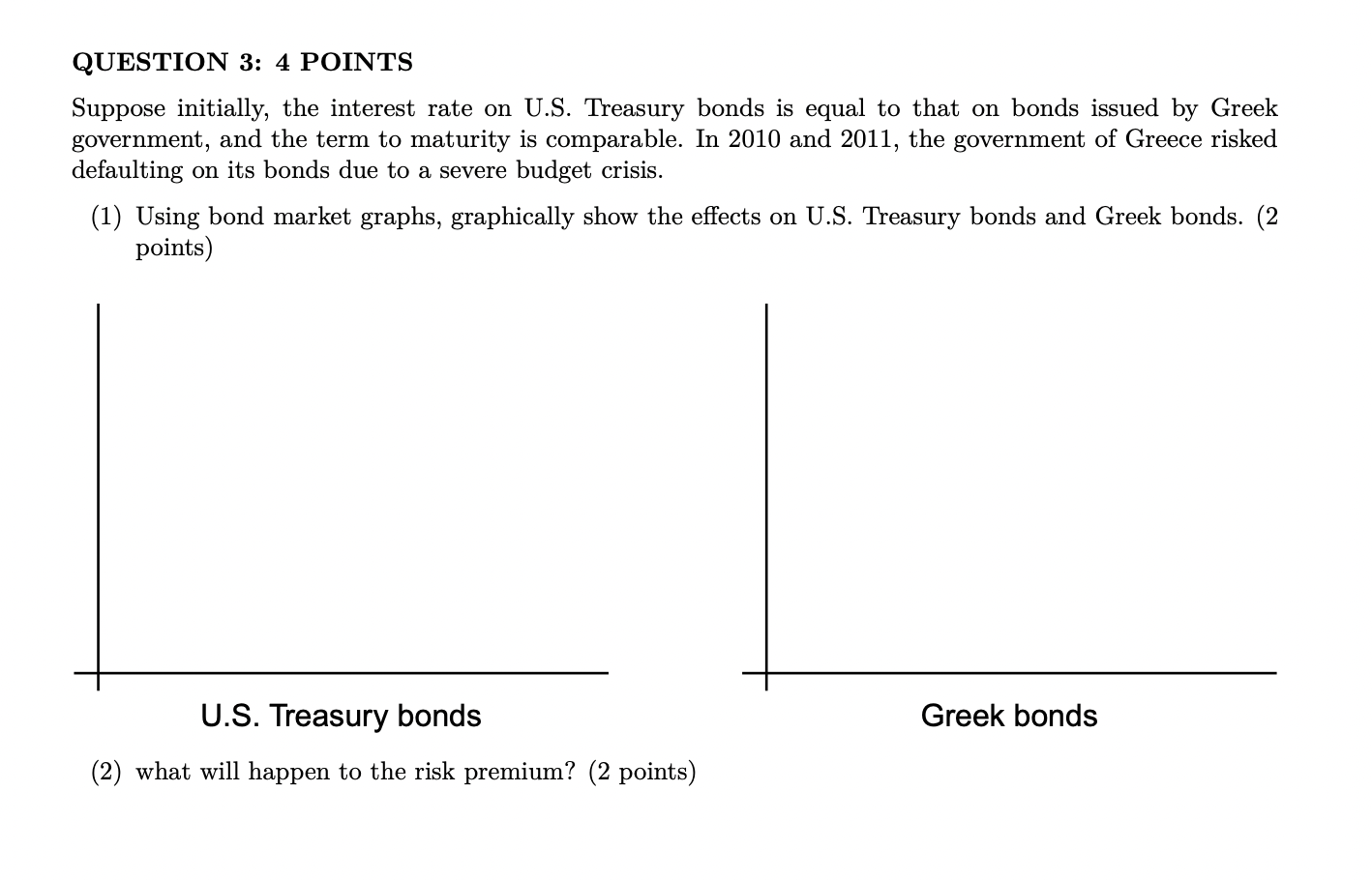

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

https://cleartax.in/s/section-80ttb

Government introduced Section 80TTB in Finance Budget 2018 to provide tax deductions for senior citizens on bank deposits interest Senior citizens can claim up to Rs 50 000 deduction from gross total income The section is effective from April 1 2018 and applicable to residents aged 60 and above There are exceptions for specific deposit

https://tax2win.in/guide/section-80ttb

Section 80TTB is a provision under the Indian Income Tax Act that offers tax benefits to senior citizens on their interest income Introduced in the Union Budget of 2018 this section aims to provide relief to senior citizens who

Government introduced Section 80TTB in Finance Budget 2018 to provide tax deductions for senior citizens on bank deposits interest Senior citizens can claim up to Rs 50 000 deduction from gross total income The section is effective from April 1 2018 and applicable to residents aged 60 and above There are exceptions for specific deposit

Section 80TTB is a provision under the Indian Income Tax Act that offers tax benefits to senior citizens on their interest income Introduced in the Union Budget of 2018 this section aims to provide relief to senior citizens who

Budget 2018 Exemption On Interest Income For Senior Citizens Hiked To

Section 80TTB AY 2021 22 Deduction On Interest Income For Senior

Solved QUESTION 2 4 POINTS Suppose The Income Tax Exemption Chegg

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

What Is Considered Low Income For Senior Citizens GoodLife 2022

SCSS Or Senior Citizen Savings Scheme Details Benefits Interest Rates

SCSS Or Senior Citizen Savings Scheme Details Benefits Interest Rates

What Is Considered Low Income For Senior Citizens GoodLife 2022