In this digital age, where screens dominate our lives, the charm of tangible, printed materials hasn't diminished. Be it for educational use in creative or artistic projects, or simply to add an individual touch to your home, printables for free have become a valuable resource. Through this post, we'll take a dive to the depths of "Income Tax Rebate On Nps Tier 1," exploring the different types of printables, where to find them, and how they can add value to various aspects of your lives.

Get Latest Income Tax Rebate On Nps Tier 1 Below

Income Tax Rebate On Nps Tier 1

Income Tax Rebate On Nps Tier 1 - Income Tax Rebate On Nps Tier 1, Income Tax Benefit On Nps Tier 1, Income Tax Deduction For Nps Tier 1, Income Tax Exemption For Nps Tier 1, Tax Benefit On Nps Tier 1, Nps Maximum Tax Rebate, Nps Tier 1 Eligible For Tax Benefit

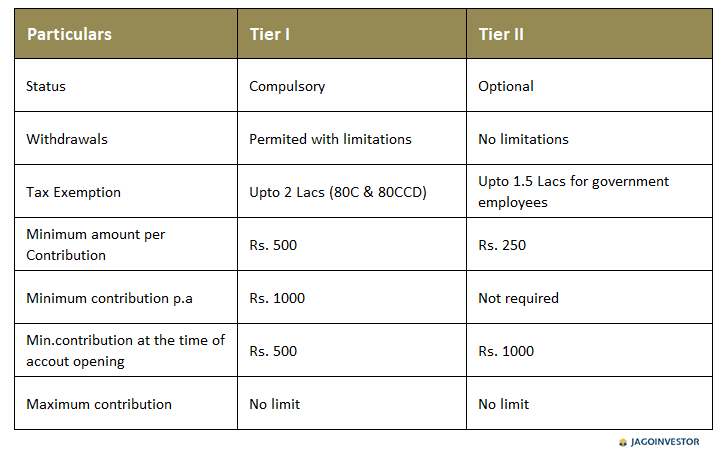

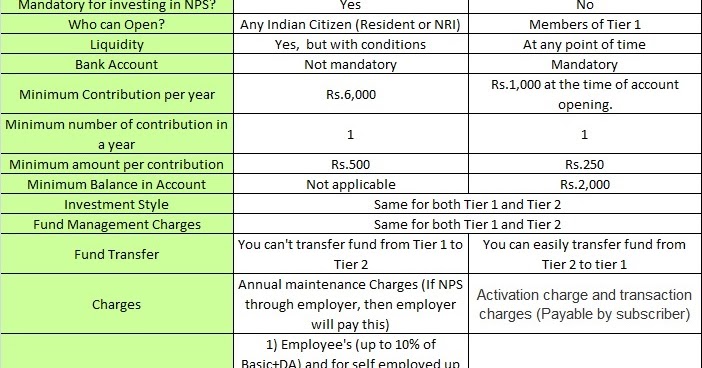

Web 6 avr 2023 nbsp 0183 32 In accordance with Section 80C of the Income Tax Act NPS Tier 1 accounts are eligible for a deduction of up to 1 5 lakh from taxable income and an additional deduction of up to

Web 21 sept 2022 nbsp 0183 32 Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of the Income Tax Act 1961 NPS tax benefits for annual contributions are as

Income Tax Rebate On Nps Tier 1 encompass a wide range of printable, free content that can be downloaded from the internet at no cost. These resources come in many types, like worksheets, templates, coloring pages, and many more. The great thing about Income Tax Rebate On Nps Tier 1 lies in their versatility and accessibility.

More of Income Tax Rebate On Nps Tier 1

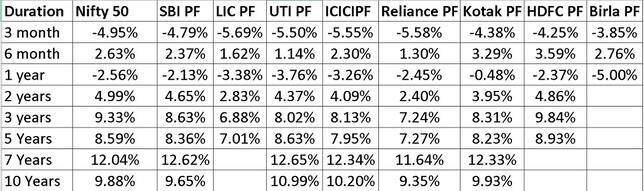

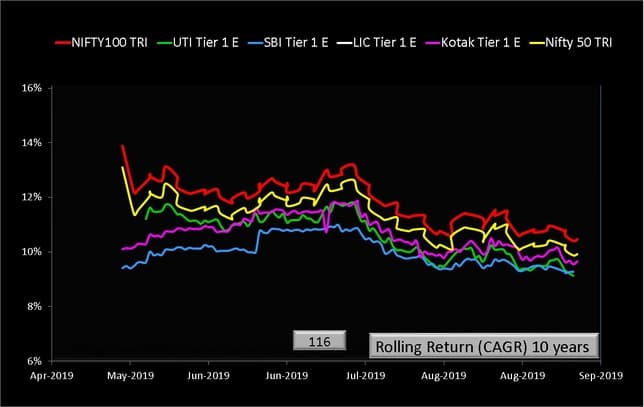

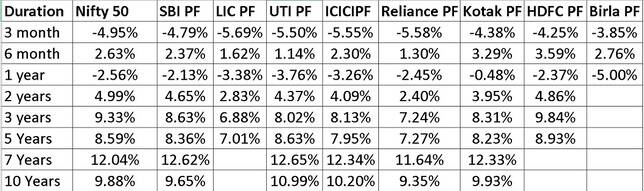

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

Web 8 f 233 vr 2019 nbsp 0183 32 Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of

Web Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD

Income Tax Rebate On Nps Tier 1 have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: There is the possibility of tailoring printing templates to your own specific requirements in designing invitations to organize your schedule or decorating your home.

-

Educational Value: These Income Tax Rebate On Nps Tier 1 offer a wide range of educational content for learners of all ages, which makes the perfect device for teachers and parents.

-

Simple: Access to the vast array of design and templates will save you time and effort.

Where to Find more Income Tax Rebate On Nps Tier 1

NPS Returns For 2018 Who Is Best NPS Fund Manager BasuNivesh

NPS Returns For 2018 Who Is Best NPS Fund Manager BasuNivesh

Web VDOM DHTML tml gt Is NPS Tier 1 eligible for an extra 50k tax benefit Quora

Web 1 sept 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of Individual

We've now piqued your interest in printables for free Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Income Tax Rebate On Nps Tier 1 for all objectives.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Income Tax Rebate On Nps Tier 1

Here are some innovative ways to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rebate On Nps Tier 1 are a treasure trove of practical and innovative resources that cater to various needs and preferences. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the endless world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial use?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with Income Tax Rebate On Nps Tier 1?

- Certain printables could be restricted regarding their use. Be sure to review the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home using your printer or visit a print shop in your area for the highest quality prints.

-

What program do I need to open printables at no cost?

- Many printables are offered in PDF format, which can be opened with free software, such as Adobe Reader.

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

Check more sample of Income Tax Rebate On Nps Tier 1 below

NPS National Pension Scheme A Beginners Guide For Rules Benefits

Your Employer s Contribution To NPS Can Make A Huge Difference

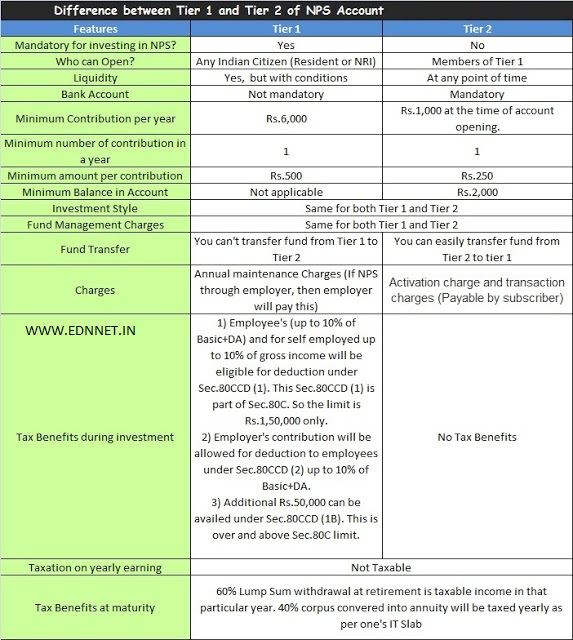

Difference Between Tier 1 And Tier 2 Account In New Pension Scheme NPS

NPS NPS TYPE NPS TAX BENFITS HOW TO INVESTMENT IN NPS NPS TIER 1 TIER

Taxation Of NPS Return From The Scheme

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://www.etmoney.com/learn/nps/nps-tax-…

Web 21 sept 2022 nbsp 0183 32 Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of the Income Tax Act 1961 NPS tax benefits for annual contributions are as

https://www.hdfcbank.com/personal/resources/learning-centre/invest/how...

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS

Web 21 sept 2022 nbsp 0183 32 Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of the Income Tax Act 1961 NPS tax benefits for annual contributions are as

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS

NPS NPS TYPE NPS TAX BENFITS HOW TO INVESTMENT IN NPS NPS TIER 1 TIER

Your Employer s Contribution To NPS Can Make A Huge Difference

Taxation Of NPS Return From The Scheme

How To Make Online Contributions To NPS Tier I And Tier II Accounts

GURUKULAM Difference Between Tier 1 And Tier 2 Account In New Pension

Best NPS Funds 2019 Top Performing NPS Scheme

Best NPS Funds 2019 Top Performing NPS Scheme

Did You Know That You Can Still Save Taxes On NPS Tier 1 In The New Tax