In this age of electronic devices, in which screens are the norm yet the appeal of tangible printed materials isn't diminishing. Be it for educational use project ideas, artistic or simply to add some personal flair to your space, Income Tax Rebate Under 80c are now an essential resource. For this piece, we'll take a dive deeper into "Income Tax Rebate Under 80c," exploring their purpose, where they are, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Rebate Under 80c Below

Income Tax Rebate Under 80c

Income Tax Rebate Under 80c - Income Tax Rebate Under 80c, Income Tax Rebate Under 80ccd(1b), Income Tax Rebate Under 80ccd, Income Tax Rebate U/s 80ccd(2), Income Tax Deductions Under 80c To 80u Pdf, Income Tax Deduction Under 80c To 80u, Income Tax Exemption Under 80ccd, Income Tax Deductions Under 80c Pdf, Income Tax Benefit Under 80ccc, Income Tax Rebate U/s 80ccd(1b)

Web 3 lignes nbsp 0183 32 6 sept 2023 nbsp 0183 32 Rebate under section 80C is only available for HUF and individuals Apart from 80C there

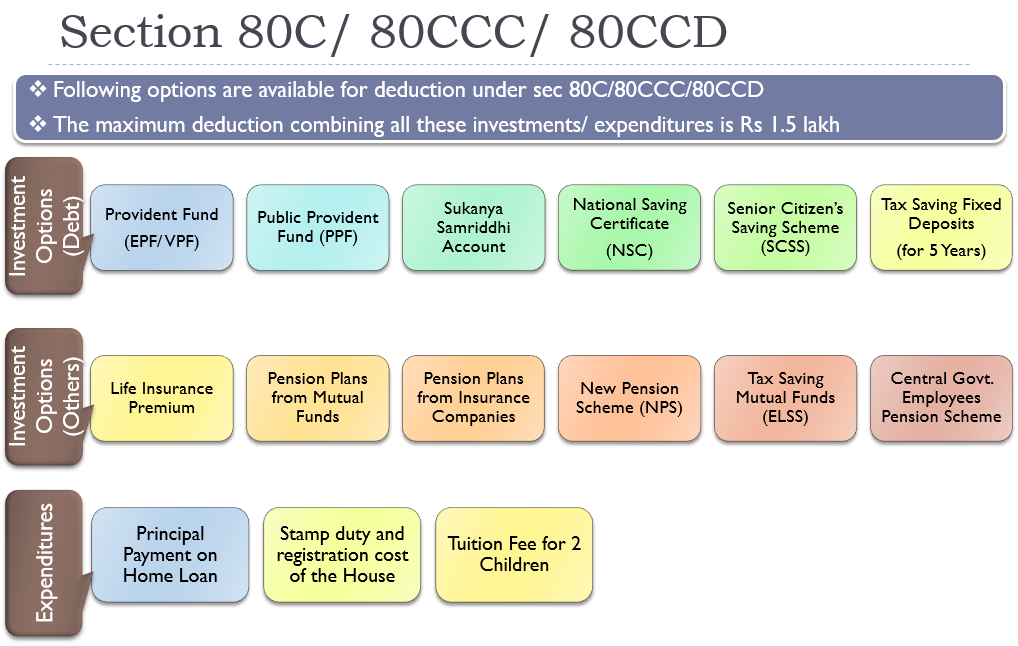

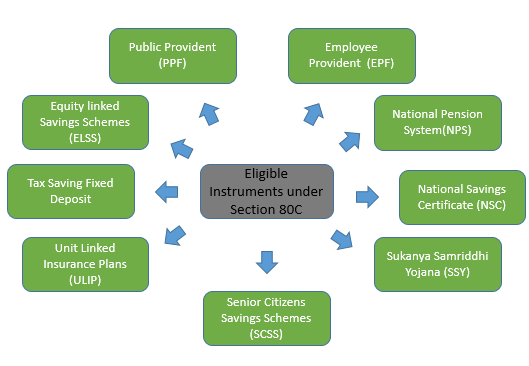

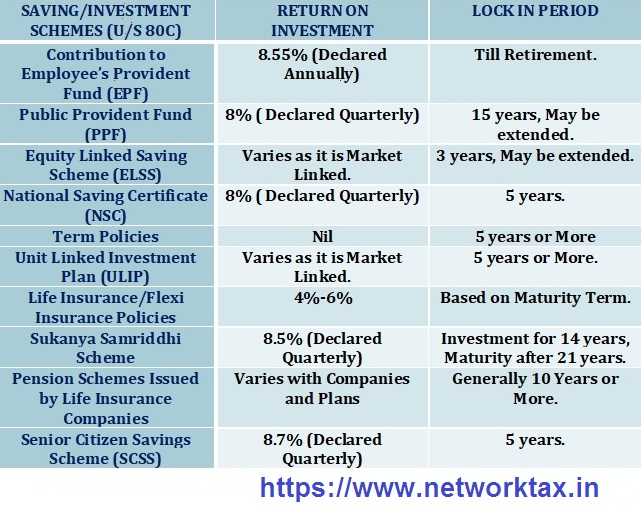

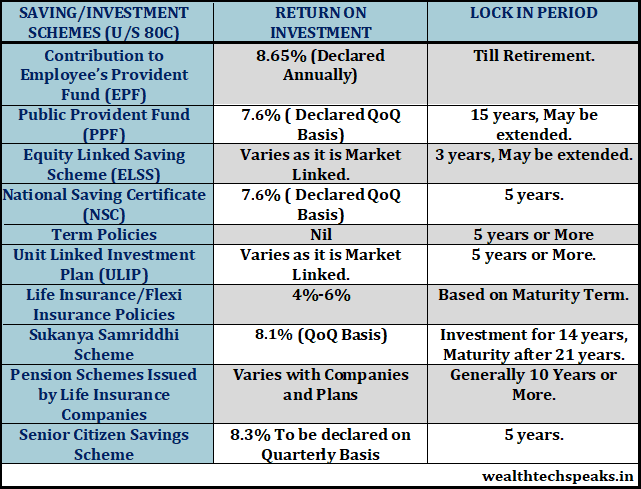

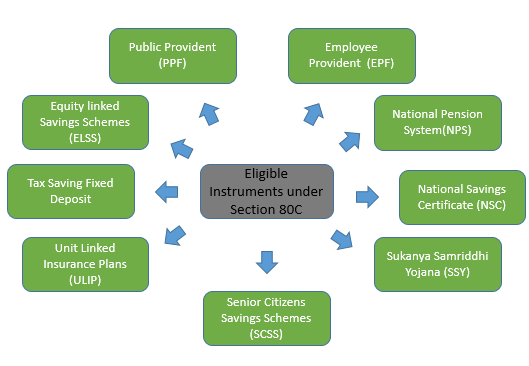

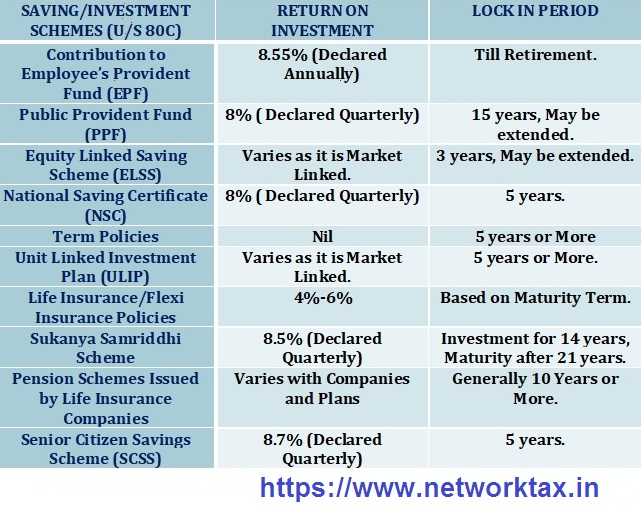

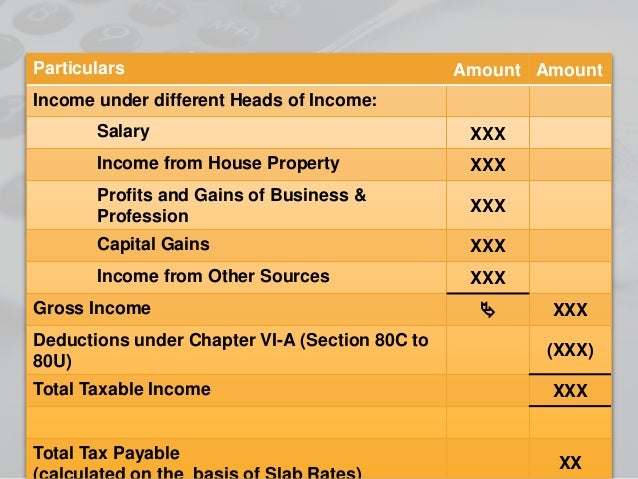

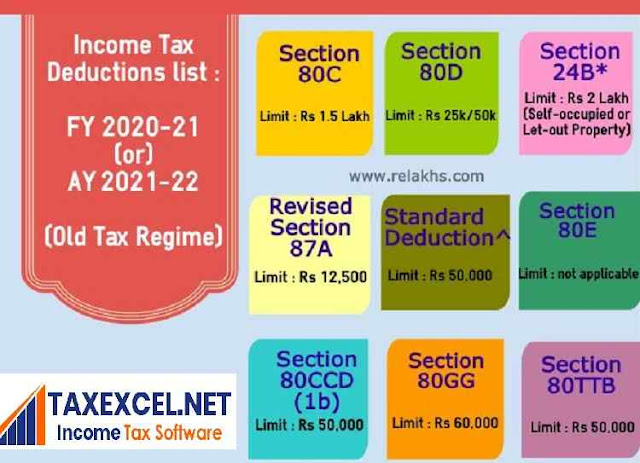

Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

Income Tax Rebate Under 80c provide a diverse array of printable resources available online for download at no cost. They are available in a variety of types, like worksheets, templates, coloring pages and more. The attraction of printables that are free is their versatility and accessibility.

More of Income Tax Rebate Under 80c

80C TO 80U DEDUCTIONS LIST PDF

80C TO 80U DEDUCTIONS LIST PDF

Web 13 juin 2019 nbsp 0183 32 Section 80C Income Tax Deduction under Section 80C Updated on 03 Aug 2023 01 19 PM Section 80C is the most popular income tax deduction for tax

Web Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum deduction

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Worth: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them a valuable tool for teachers and parents.

-

The convenience of Quick access to various designs and templates can save you time and energy.

Where to Find more Income Tax Rebate Under 80c

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

Web Tax benefit of 54 600 46 800 under Section 80C amp 7 800 under Section 80D is calculated at the highest tax slab rate of 31 2 including Cess excluding surcharge on

Web 22 juin 2018 nbsp 0183 32 Investors can invest up to 1 50 000 in an ELSS fund and deduct the investment from their taxable income under section 80C of Income Tax Act thereby effectively reducing their tax liability Long term capital gains and dividends received on these investments are tax free in the hands of the investor as per the current tax laws

In the event that we've stirred your interest in Income Tax Rebate Under 80c Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Income Tax Rebate Under 80c for different needs.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Income Tax Rebate Under 80c

Here are some unique ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Rebate Under 80c are an abundance of practical and imaginative resources that can meet the needs of a variety of people and desires. Their access and versatility makes them a great addition to your professional and personal life. Explore the vast world of Income Tax Rebate Under 80c right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate Under 80c really completely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Do I have the right to use free printables in commercial projects?

- It's based on the terms of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright problems with Income Tax Rebate Under 80c?

- Some printables may come with restrictions concerning their use. Check the conditions and terms of use provided by the author.

-

How do I print Income Tax Rebate Under 80c?

- You can print them at home using your printer or visit a local print shop to purchase top quality prints.

-

What program is required to open printables at no cost?

- Most PDF-based printables are available in the format PDF. This can be opened using free programs like Adobe Reader.

80ccc Pension Plan Investor Guruji

How To Claim Health Insurance Under Section 80D From 2018 19

Check more sample of Income Tax Rebate Under 80c below

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Deduction Under Section 80C Its Allied Sections

Budget 2014 Impact On Money Taxes And Savings

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

Deduction Under Section 80C A Complete List BasuNivesh

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

https://tax2win.in/guide/deductions

Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

https://www.bankbazaar.com/tax/deductions-under-80c.html

Web 11 sept 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different

Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

Web 11 sept 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

Deduction Under Section 80C Its Allied Sections

Deduction Under Section 80C A Complete List BasuNivesh

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

Deduction Under Chapter VI A section 80C 80U Income Tax 1961

Income Tax For Under Construction House The Property Files

Income Tax For Under Construction House The Property Files

List Of Different Derivations Under Section 80C With Automated Income