In a world in which screens are the norm it's no wonder that the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses as well as creative projects or simply adding an element of personalization to your space, Income Tax Rebate Under Sec 80d have become an invaluable source. We'll take a dive to the depths of "Income Tax Rebate Under Sec 80d," exploring the different types of printables, where they are, and how they can enhance various aspects of your life.

Get Latest Income Tax Rebate Under Sec 80d Below

Income Tax Rebate Under Sec 80d

Income Tax Rebate Under Sec 80d - Income Tax Rebate Under Section 80d, Income Tax Rebate Under Section 80ddb, Income Tax Rebate Under Section 80dd, Income Tax Deduction Under Section 80d, Income Tax Deduction Under Section 80dd, Income Tax Relief Under Section 80d, Income Tax Exemption Limit Under Section 80dd, Income Tax Exemption Limit Under Section 80d, Income Tax Medical Bills Exemption Under Section 80d, What Is Deduction Under Section 80d

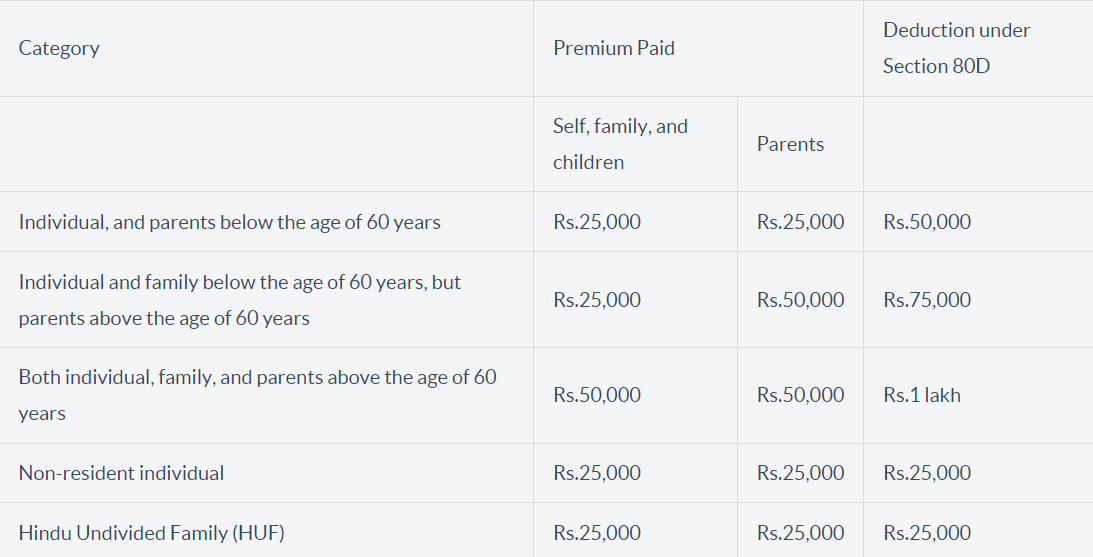

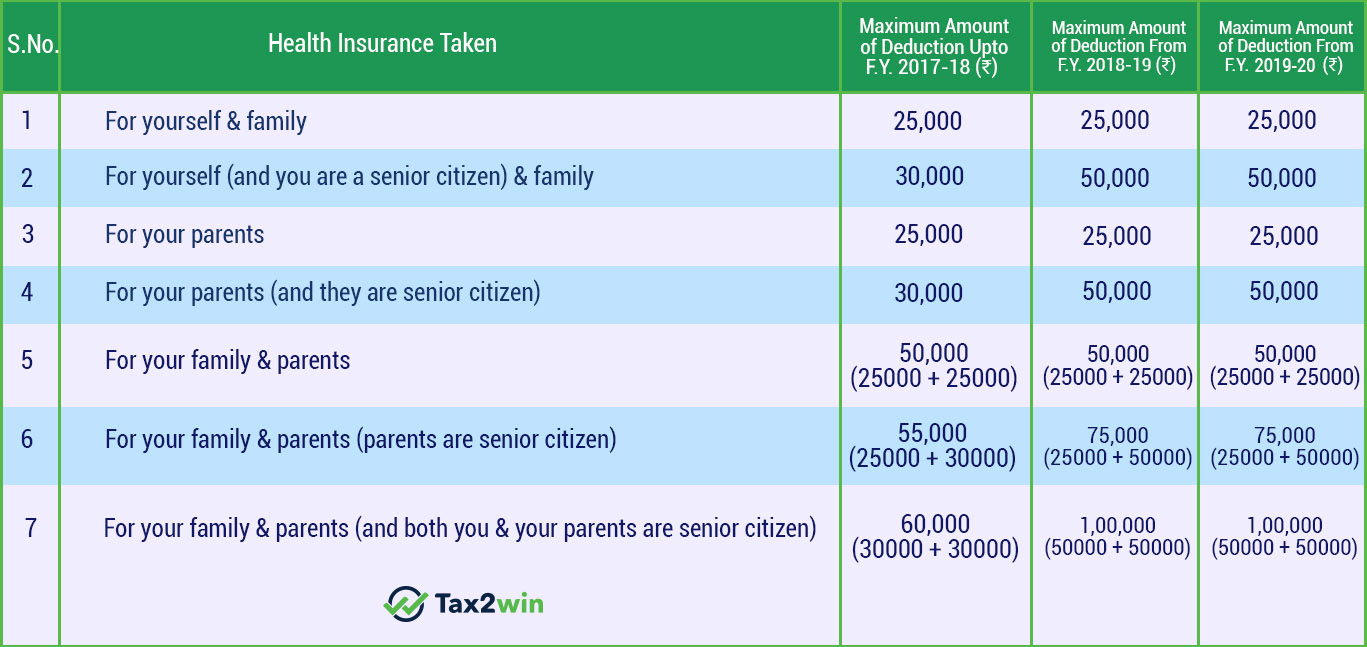

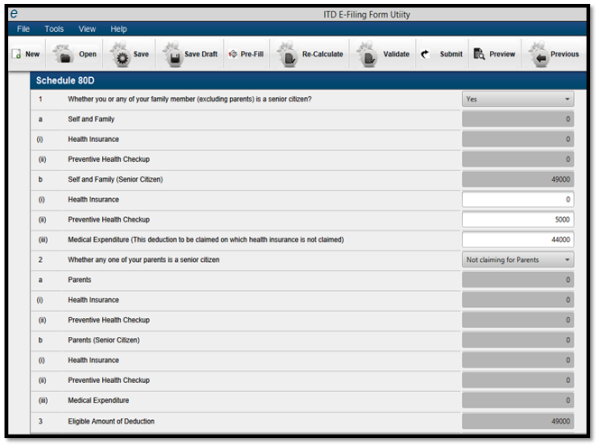

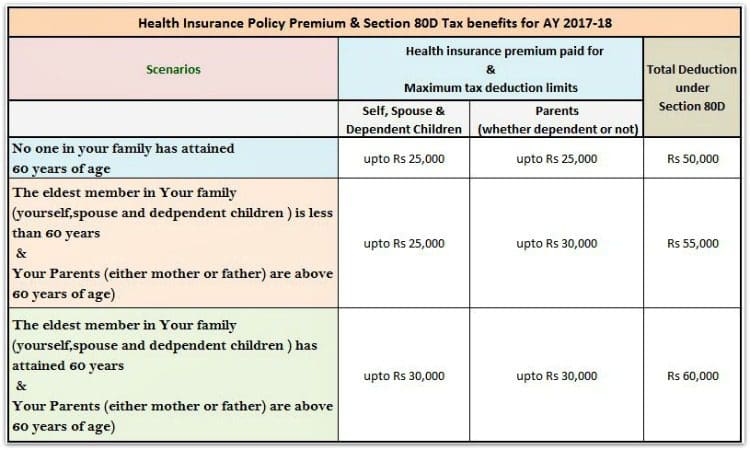

Web 12 sept 2023 nbsp 0183 32 Deductions under Section 80D provide tax savings benefits for expenses related to health and critical illness insurance You can take advantage of Section

Web Deduction Under Section 80D Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr

Printables for free include a vast variety of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of types, such as worksheets templates, coloring pages and many more. The attraction of printables that are free is in their versatility and accessibility.

More of Income Tax Rebate Under Sec 80d

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Web 9 mars 2023 nbsp 0183 32 Tax deduction under Section 80D Rs 39 000 Rs 12 000 Rs 22 000 Rs 5 000

Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Income tax

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor printables to your specific needs be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost cater to learners of all ages, making these printables a powerful instrument for parents and teachers.

-

Accessibility: You have instant access numerous designs and templates saves time and effort.

Where to Find more Income Tax Rebate Under Sec 80d

Section 80D Income Tax Deduction For Medical Insurance Preventive

Section 80D Income Tax Deduction For Medical Insurance Preventive

Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to Rs

Web There is one more benefit of subscribing to a Mediclaim policy and that is tax rebate Under Sec 80D you are eligible for deduction up to Rs 75 000 with the following conditions

Since we've got your curiosity about Income Tax Rebate Under Sec 80d Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Rebate Under Sec 80d to suit a variety of needs.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Income Tax Rebate Under Sec 80d

Here are some unique ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Rebate Under Sec 80d are a treasure trove of useful and creative resources designed to meet a range of needs and hobbies. Their availability and versatility make these printables a useful addition to both professional and personal life. Explore the plethora of Income Tax Rebate Under Sec 80d now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes they are! You can print and download these materials for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It is contingent on the specific conditions of use. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright violations with Income Tax Rebate Under Sec 80d?

- Some printables may contain restrictions in use. Be sure to review these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home with your printer or visit any local print store for more high-quality prints.

-

What software do I require to view printables free of charge?

- The majority of printables are in PDF format. They can be opened with free programs like Adobe Reader.

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Section 80D Income Tax Deduction For Medical Insurance Preventive

Check more sample of Income Tax Rebate Under Sec 80d below

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

Deduction Under 80D Tips Before Investing In A Health Insurance Plan

Section 80D Of Income Tax Act Know The Deduction Limit For AY 2020 21

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Web Deduction Under Section 80D Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr

https://economictimes.indiatimes.com/wealth/tax/you-can-claim-maximum...

Web 15 f 233 vr 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual

Web Deduction Under Section 80D Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr

Web 15 f 233 vr 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual

Section 80D Of Income Tax Act Know The Deduction Limit For AY 2020 21

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

How To Claim Health Insurance Under Section 80D From 2018 19

How To Claim Health Insurance Under Section 80D From 2018 19

Tax Saving On Health Insurance Section 80D Detailed Guide For FY