In this age of electronic devices, in which screens are the norm but the value of tangible printed objects hasn't waned. In the case of educational materials as well as creative projects or just adding the personal touch to your space, Medical Deduction In Income Tax have proven to be a valuable resource. Through this post, we'll dive into the world "Medical Deduction In Income Tax," exploring the different types of printables, where to locate them, and how they can improve various aspects of your daily life.

Get Latest Medical Deduction In Income Tax Below

Medical Deduction In Income Tax

Medical Deduction In Income Tax - Medical Deduction In Income Tax, Medical Rebate In Income Tax, Medical Expenses In Income Tax, Medical Benefits In Income Tax, Medical Expenses Deduction In Income Tax, Medical Treatment Deduction In Income Tax, Medical Bill Deduction In Income Tax, Medical Allowance Deduction In Income Tax, Medical Reimbursement Deduction In Income Tax, Medicine Expenses Deduction In Income Tax

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents

Printables for free include a vast selection of printable and downloadable items that are available online at no cost. They come in many styles, from worksheets to templates, coloring pages and much more. The great thing about Medical Deduction In Income Tax is in their variety and accessibility.

More of Medical Deduction In Income Tax

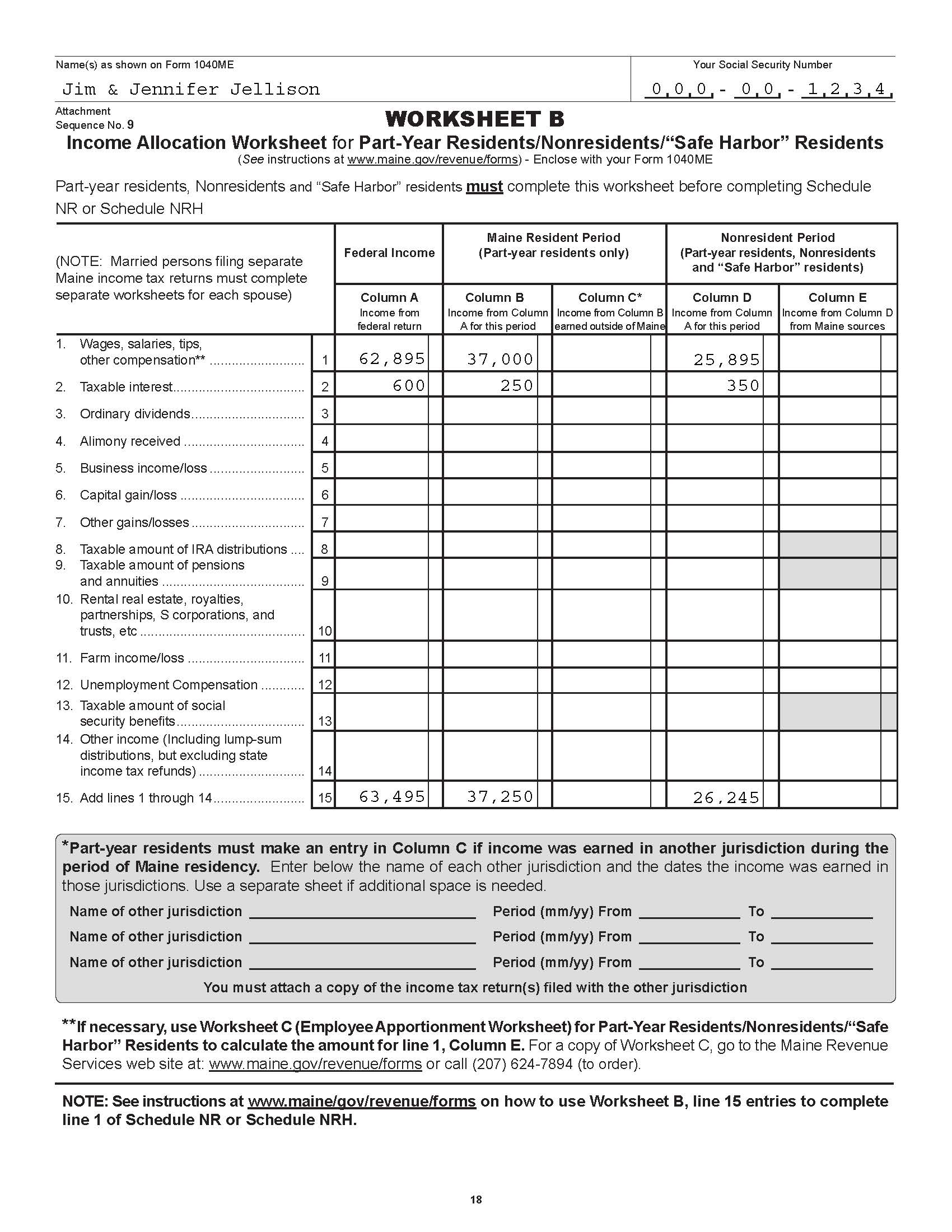

How To Calculate Standard Deduction In Income Tax Act Scripbox

How To Calculate Standard Deduction In Income Tax Act Scripbox

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if

To claim deduction under Section 80DD you will need to submit a certificate in Form 10IA attested by medical authority This certificate is for certifying the person with disability severe disability cerebral palsy autism and multiple disability for purposes of section 80DD

Medical Deduction In Income Tax have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization They can make the templates to meet your individual needs in designing invitations planning your schedule or even decorating your house.

-

Educational Value: Education-related printables at no charge can be used by students of all ages, making them a great instrument for parents and teachers.

-

Simple: immediate access an array of designs and templates will save you time and effort.

Where to Find more Medical Deduction In Income Tax

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY

This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in

Since we've got your interest in printables for free we'll explore the places you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Medical Deduction In Income Tax for various reasons.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a wide range of topics, that range from DIY projects to planning a party.

Maximizing Medical Deduction In Income Tax

Here are some inventive ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Medical Deduction In Income Tax are an abundance filled with creative and practical information for a variety of needs and passions. Their accessibility and flexibility make them an essential part of every aspect of your life, both professional and personal. Explore the vast array of Medical Deduction In Income Tax and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes, they are! You can print and download these tools for free.

-

Do I have the right to use free printables for commercial purposes?

- It's contingent upon the specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with Medical Deduction In Income Tax?

- Some printables may have restrictions concerning their use. Be sure to read the terms and conditions set forth by the author.

-

How do I print printables for free?

- You can print them at home using any printer or head to an area print shop for the highest quality prints.

-

What program must I use to open printables that are free?

- The majority are printed as PDF files, which can be opened using free software like Adobe Reader.

Medical Expenses Deduction Under Income Tax Act 2023 Update

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized

Check more sample of Medical Deduction In Income Tax below

What Is Standard Deduction In Income Tax Means PHYSCIQ

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Deduction In Income Tax U s 80C To 80U Chapter VIA Tax Savings In ITR

Income Tax Deductions For The FY 2019 20 ComparePolicy

Preventive Check Up 80d Wkcn

Deduction In Income Tax The Income Tax Department Has Thou Flickr

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents

https://www.nerdwallet.com/article/taxes/me…

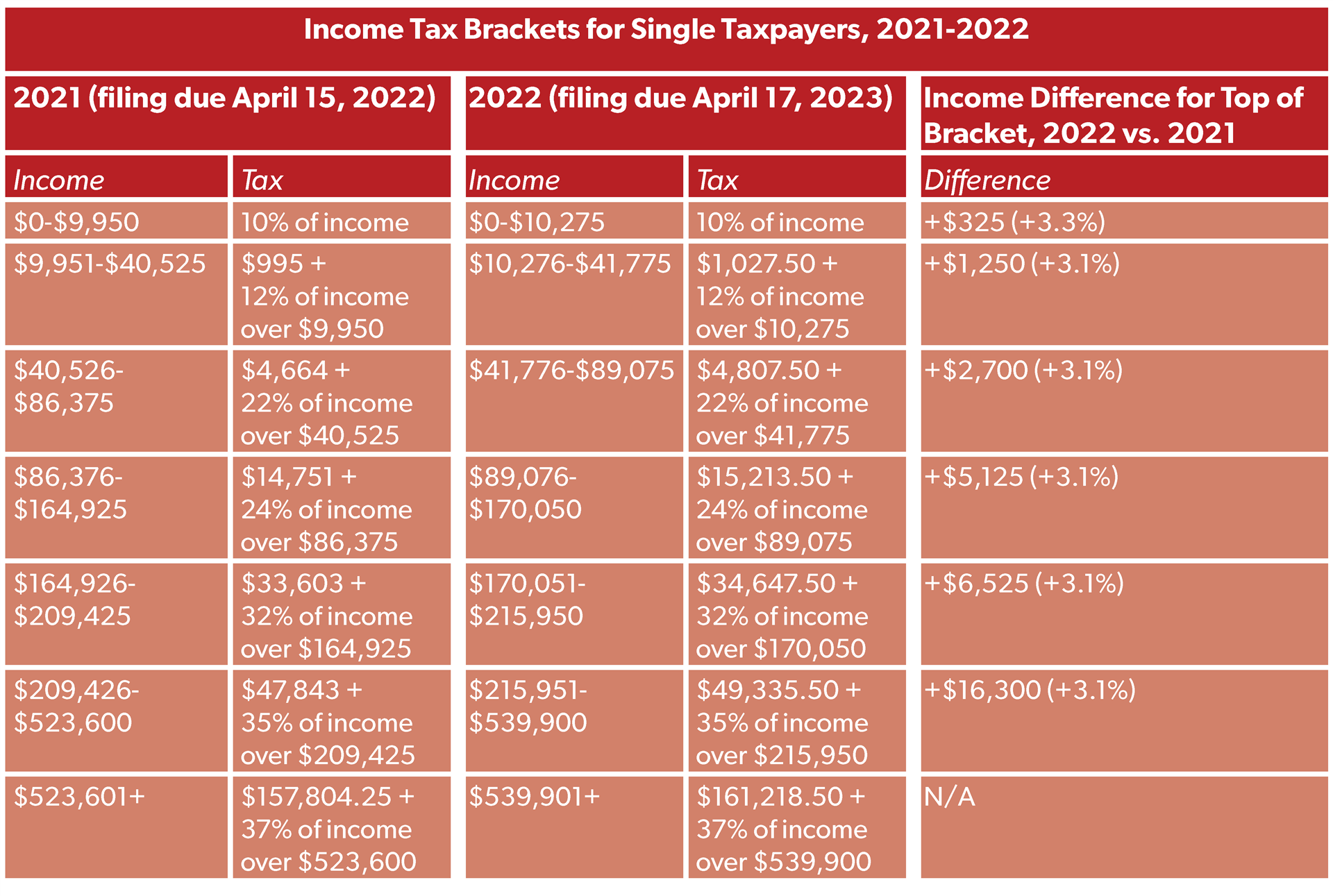

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Income Tax Deductions For The FY 2019 20 ComparePolicy

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Preventive Check Up 80d Wkcn

Deduction In Income Tax The Income Tax Department Has Thou Flickr

Printable Itemized Deductions Worksheet

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

What Is The Standard Federal Tax Deduction Ericvisser