In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials, creative projects, or just adding an individual touch to your area, Ppf Rebate Under Section have become an invaluable resource. The following article is a dive to the depths of "Ppf Rebate Under Section," exploring what they are, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Ppf Rebate Under Section Below

Ppf Rebate Under Section

Ppf Rebate Under Section - Ppf Rebate Under Section, Ppf Deduction Under Section, Ppf Deduction Under Section 80c, Ppf Interest Rebate Under Section, Ppf Interest Deduction Under Section 80c, Maximum Ppf Deduction Under Section 80c, What Is Ppf Under 80c, Does Ppf Account Comes Under 80c, Does Ppf Comes Under 80c

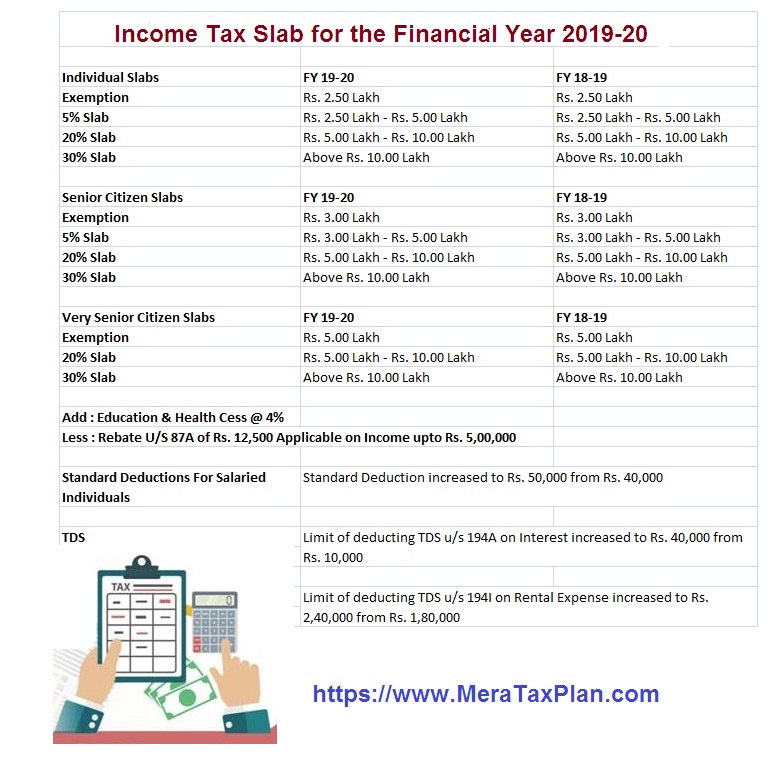

Public Provident Fund PPF and Employee Provident Fund EPF are investments with long term retirement benefits Both investments are entitled to deduction under Section

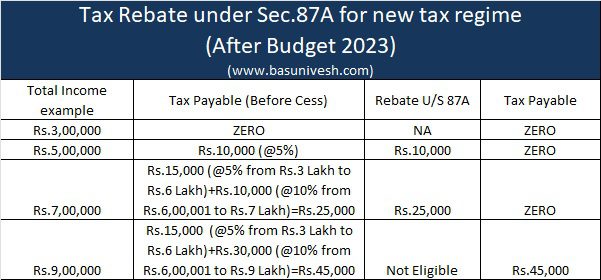

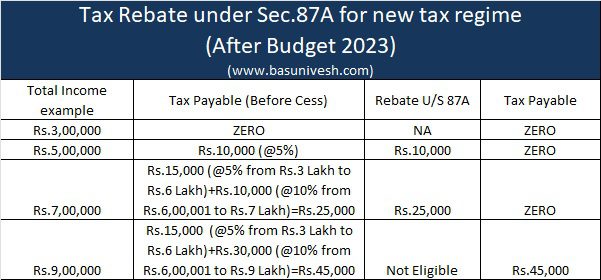

A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual which means

Ppf Rebate Under Section cover a large variety of printable, downloadable items that are available online at no cost. They are available in numerous forms, like worksheets coloring pages, templates and more. The appeal of printables for free is their flexibility and accessibility.

More of Ppf Rebate Under Section

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Interest on PPF is completely tax free without any limit It is not taxable at the time of accrual nor at the time of receipt under Section 10 11 Maturity as well as premature

PPF offers a maximum tax deduction of up to Rs 1 5 lakh for investments made in each financial year under section 80C of the Income tax Act 1961 Under which section of the

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Personalization The Customization feature lets you tailor designs to suit your personal needs be it designing invitations or arranging your schedule or decorating your home.

-

Education Value Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes the perfect source for educators and parents.

-

Simple: You have instant access various designs and templates, which saves time as well as effort.

Where to Find more Ppf Rebate Under Section

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

To claim a tax benefit of Rs 1 5 lakh under section 80C you need to have your extra money either from income or income from other sources parked into investment schemes

The limit of Rs 1 50 lakh is applicable whether you wish to claim the benefit under Section 80C or not for contribution made to the PPF account of your daughter

We've now piqued your interest in printables for free Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Ppf Rebate Under Section for different applications.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs are a vast selection of subjects, ranging from DIY projects to planning a party.

Maximizing Ppf Rebate Under Section

Here are some ideas that you can make use of Ppf Rebate Under Section:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Ppf Rebate Under Section are a treasure trove of useful and creative resources catering to different needs and interests. Their accessibility and versatility make them an essential part of the professional and personal lives of both. Explore the world that is Ppf Rebate Under Section today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can download and print these resources at no cost.

-

Does it allow me to use free templates for commercial use?

- It's based on the conditions of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions on their use. You should read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home with an printer, or go to an in-store print shop to get better quality prints.

-

What program must I use to open printables that are free?

- A majority of printed materials are in PDF format. These is open with no cost software, such as Adobe Reader.

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Check more sample of Ppf Rebate Under Section below

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Invest In Tax saving MFs To Enjoy Dual Benefits

Section 87A How Is Income Up To Seven Lakhs Tax free BasuNivesh

Income Tax Rebate To PPF Top 5 Budget 2022 Announcements Expected Mint

https://cleartax.in/s/80c-80-deductions

A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual which means

https://taxguru.in/income-tax/public-provident...

Interest received on bank ppf account is tax free which we can not able to withdraw from the ppf account for 7 years can the amount of interest is eligible as new investment in

A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual which means

Interest received on bank ppf account is tax free which we can not able to withdraw from the ppf account for 7 years can the amount of interest is eligible as new investment in

Invest In Tax saving MFs To Enjoy Dual Benefits

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Section 87A How Is Income Up To Seven Lakhs Tax free BasuNivesh

Income Tax Rebate To PPF Top 5 Budget 2022 Announcements Expected Mint

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

What Is Rebate Under Section 87A And Who Can Claim It

What Is Rebate Under Section 87A And Who Can Claim It

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate