Today, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. Be it for educational use and creative work, or simply to add personal touches to your home, printables for free have become an invaluable source. Through this post, we'll dive deep into the realm of "Rebate U S 89 Income Tax," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Rebate U S 89 Income Tax Below

Rebate U S 89 Income Tax

Rebate U S 89 Income Tax - Relief U/s 89 Income Tax, Relief U/s 89 Income Tax Act, Relief U/s 89(1) Of Income-tax Act, What Is Rebate U/s 89, How Is Section 89 Rebate Calculated

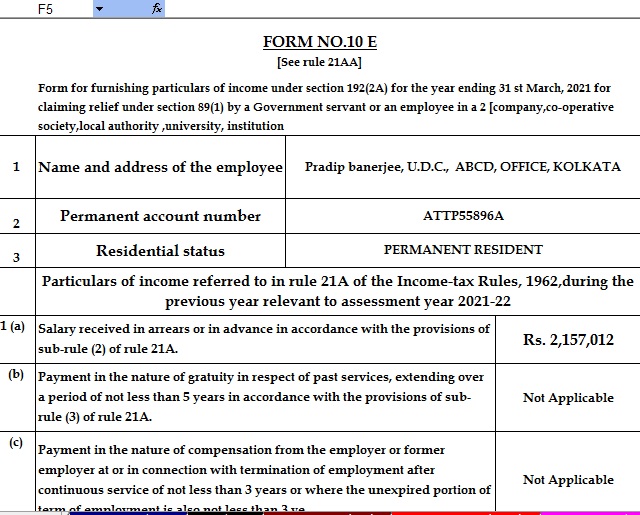

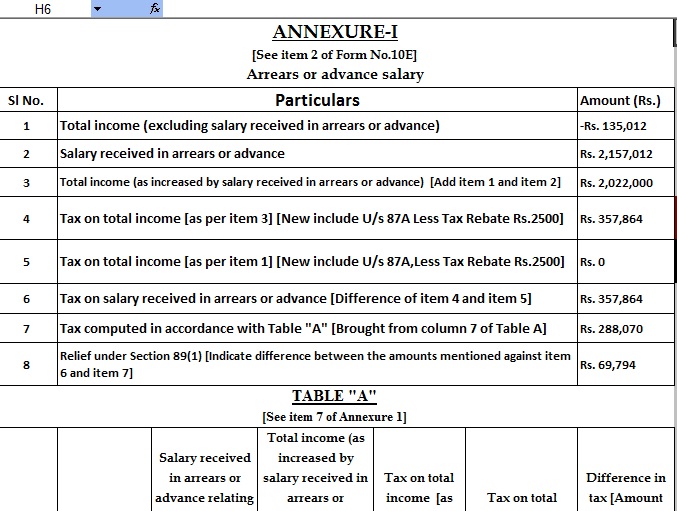

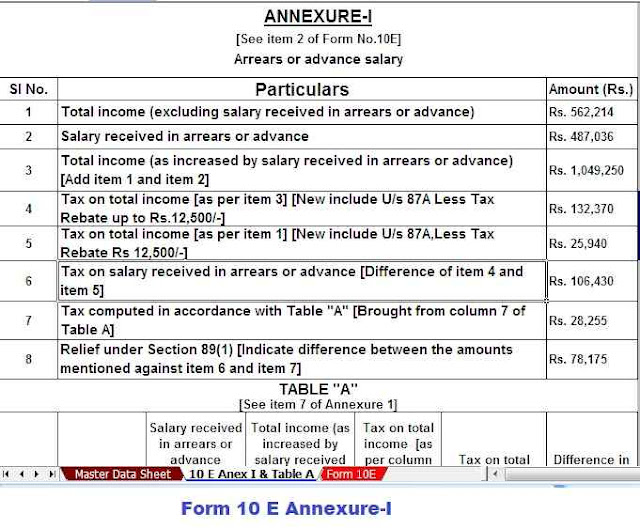

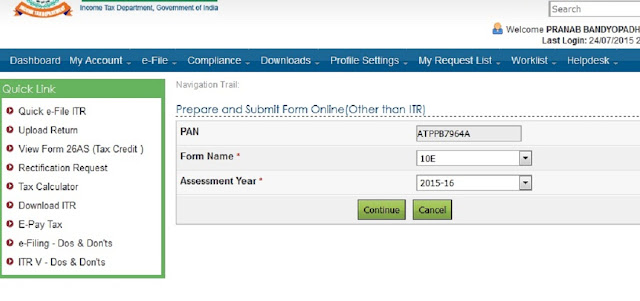

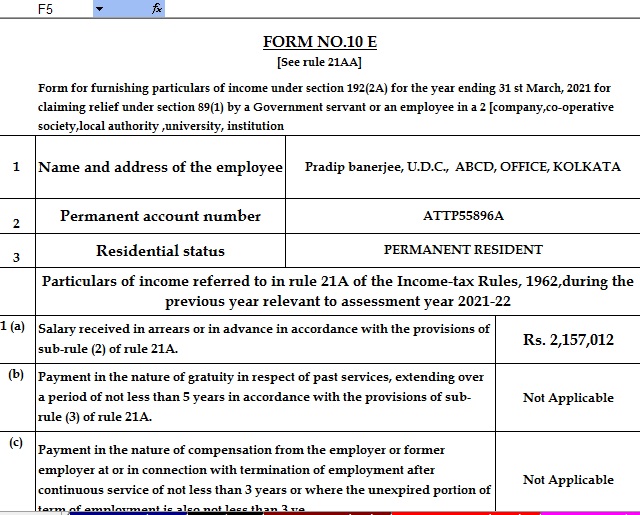

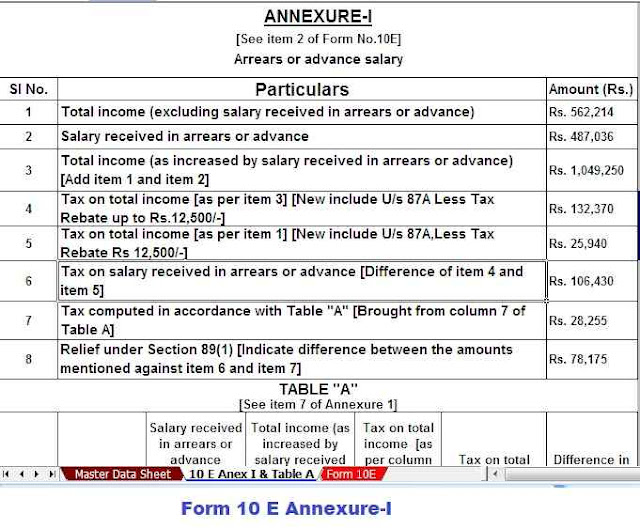

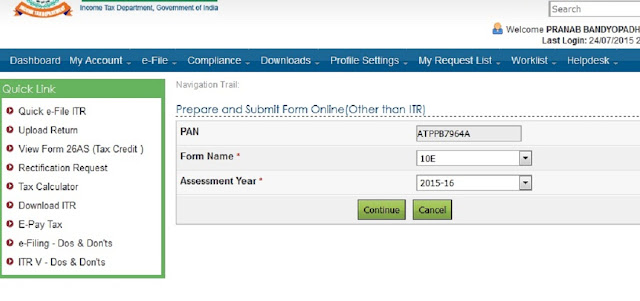

Web It has to be filed online at the e filing portal of the income tax department As per Section 89 1 tax relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertain

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than

Rebate U S 89 Income Tax cover a large range of printable, free materials online, at no cost. These resources come in many types, such as worksheets templates, coloring pages, and much more. The great thing about Rebate U S 89 Income Tax lies in their versatility as well as accessibility.

More of Rebate U S 89 Income Tax

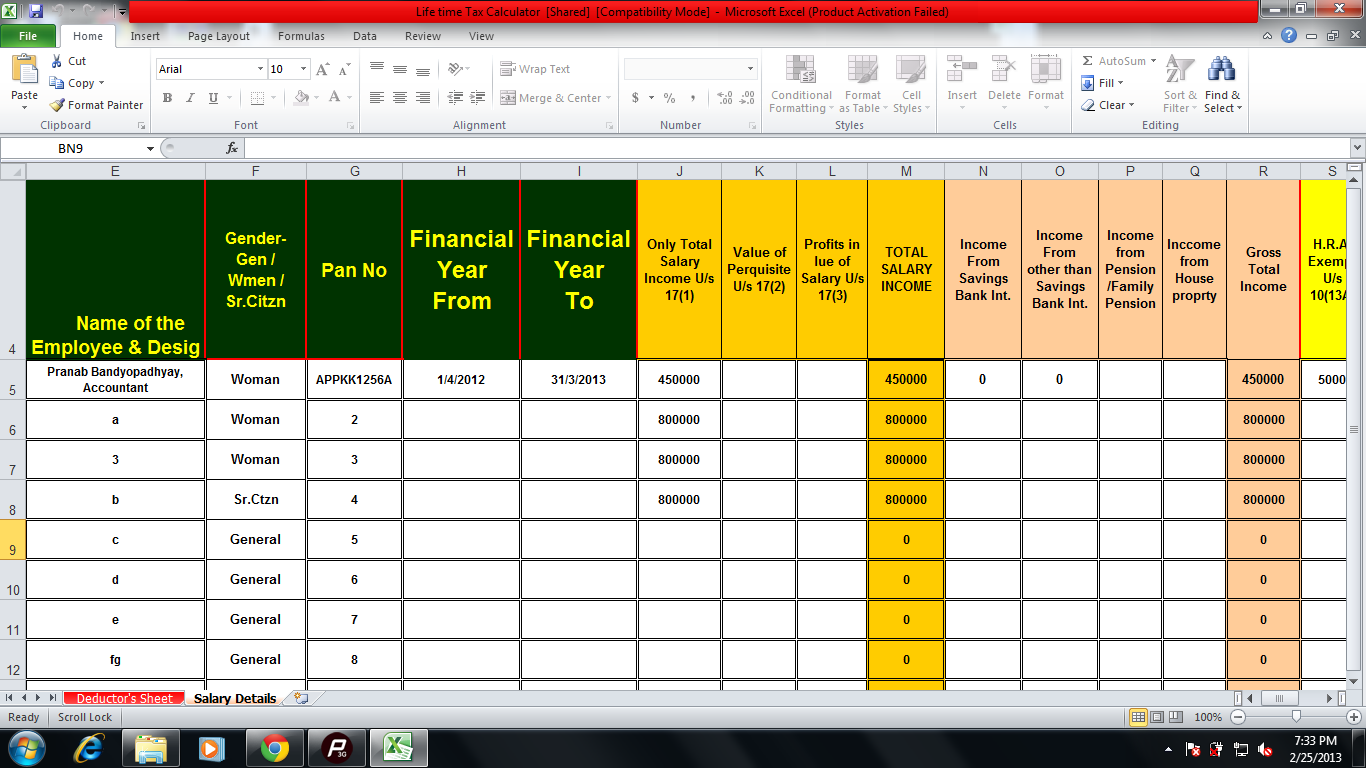

Income Tax Arrears Relief Calculator U s 89 1

Income Tax Arrears Relief Calculator U s 89 1

Web 28 mai 2012 nbsp 0183 32 If an individual receives any portion of his salary in arrears or in advance or receives profit in lieu of salary or has received salary in any financial year for more than

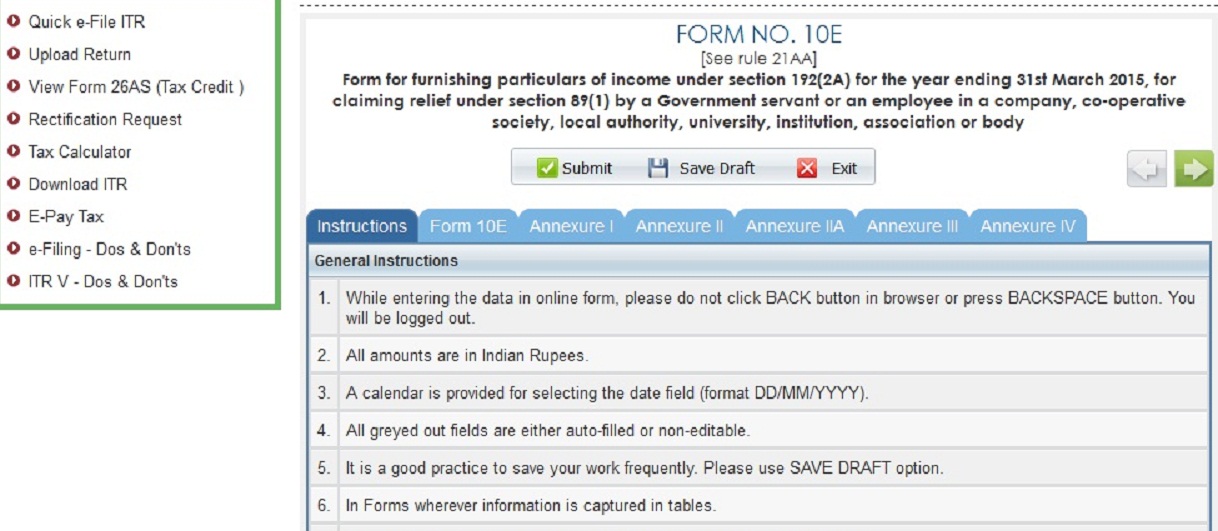

Web 1 oct 2021 nbsp 0183 32 When tax relief u s 89 is claimed one need to file form 10e in order to claim tax relief on arrears salary discuss on our next video Topic covered in this video

Rebate U S 89 Income Tax have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: We can customize the design to meet your needs be it designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value These Rebate U S 89 Income Tax offer a wide range of educational content for learners of all ages, making them a vital instrument for parents and teachers.

-

Convenience: instant access an array of designs and templates reduces time and effort.

Where to Find more Rebate U S 89 Income Tax

Now It Is Compulsory To Upload Form 10E For Claim Relief U s 89 1 To

Now It Is Compulsory To Upload Form 10E For Claim Relief U s 89 1 To

Web 27 f 233 vr 2020 nbsp 0183 32 As per the Income Tax Act 1961 the Income Tax Section 89 1 a taxpayer can receive relief of salary relevant to the previous year s earning Section 89 1 is

Web 8 mai 2023 nbsp 0183 32 Taxpayers who have claimed relief under Section 89 1 but have not filed form 10E have received an income tax notice from the Tax Department stating that The

Now that we've ignited your curiosity about Rebate U S 89 Income Tax We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of objectives.

- Explore categories such as home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing Rebate U S 89 Income Tax

Here are some fresh ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets from the internet to aid in learning at your home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Rebate U S 89 Income Tax are an abundance of innovative and useful resources designed to meet a range of needs and passions. Their accessibility and versatility make them an essential part of the professional and personal lives of both. Explore the vast world of Rebate U S 89 Income Tax today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes, they are! You can download and print these tools for free.

-

Are there any free printouts for commercial usage?

- It depends on the specific conditions of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright concerns with Rebate U S 89 Income Tax?

- Certain printables may be subject to restrictions regarding their use. Be sure to review the terms and regulations provided by the author.

-

How do I print Rebate U S 89 Income Tax?

- Print them at home with an printer, or go to a print shop in your area for high-quality prints.

-

What software do I need to run Rebate U S 89 Income Tax?

- The majority of printed documents are in PDF format. These is open with no cost software, such as Adobe Reader.

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Check more sample of Rebate U S 89 Income Tax below

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

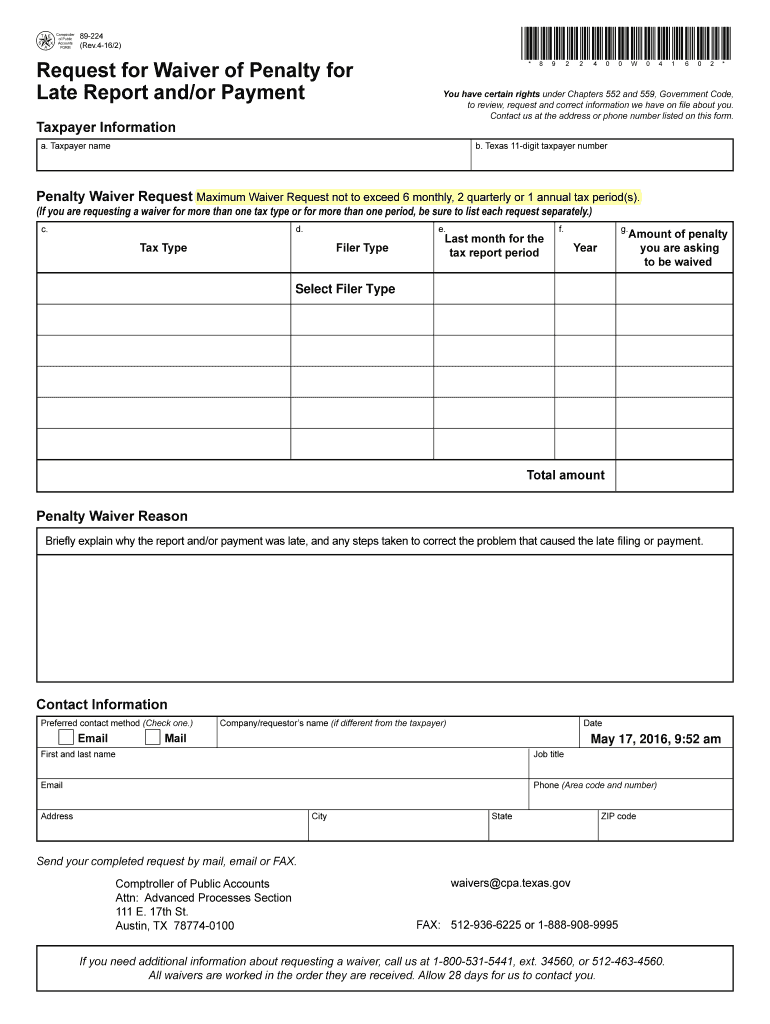

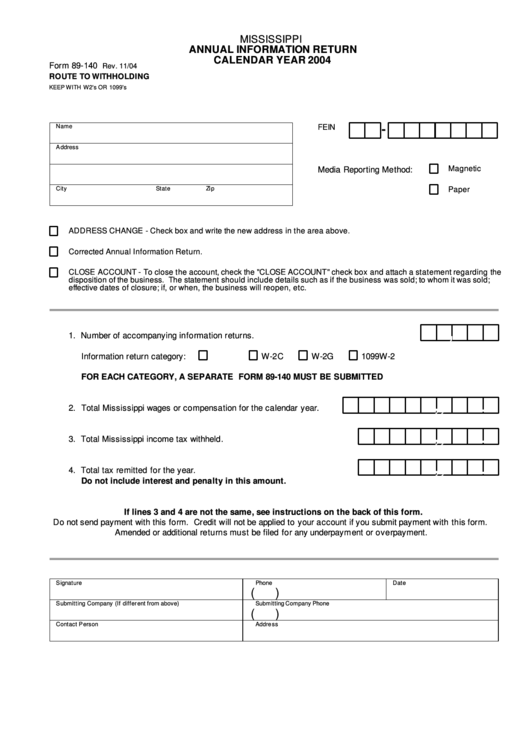

Form 89 224 Fill Out And Sign Printable PDF Template SignNow

Form 10E Claim Income Tax Relief Under Section 89 1 Tax2win

Calculate Your Income Tax Relief U s 89 1 For A Y 2012 13 Absolutely

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

https://incometaxindia.gov.in/Pages/tools/relief-under-section-89.aspx

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than

https://maxutils.com/income/calculate-tax-relief-us89

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous

Form 10E Claim Income Tax Relief Under Section 89 1 Tax2win

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Calculate Your Income Tax Relief U s 89 1 For A Y 2012 13 Absolutely

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

Form 89 140 Annual Information Return 2004 Printable Pdf Download

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

Income Tax Relief Indian Income Tax Relief U S 89