In a world when screens dominate our lives and the appeal of physical printed objects hasn't waned. Whether it's for educational purposes, creative projects, or just adding an individual touch to your space, Federal Energy Tax Credit For Air Conditioners are now an essential resource. The following article is a take a dive into the world of "Federal Energy Tax Credit For Air Conditioners," exploring what they are, how to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Federal Energy Tax Credit For Air Conditioners Below

Federal Energy Tax Credit For Air Conditioners

Federal Energy Tax Credit For Air Conditioners - Federal Energy Tax Credit For Air Conditioners, Federal Tax Credits For Energy Efficient Air Conditioners, What Qualifies For Federal Energy Tax Credit, What Is The Federal Energy Tax Credit, How Does The Federal Energy Tax Credit Work, Is There A Tax Credit For Energy Efficient Hvac, What Is A Federal Tax Credit For Energy Efficiency

Verkko 22 jouluk 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Verkko 25 lokak 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

Federal Energy Tax Credit For Air Conditioners cover a large assortment of printable, downloadable materials available online at no cost. These resources come in many types, like worksheets, templates, coloring pages, and much more. The benefit of Federal Energy Tax Credit For Air Conditioners is their flexibility and accessibility.

More of Federal Energy Tax Credit For Air Conditioners

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

Verkko General Overview of the Energy Efficient Home Improvement Credit Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

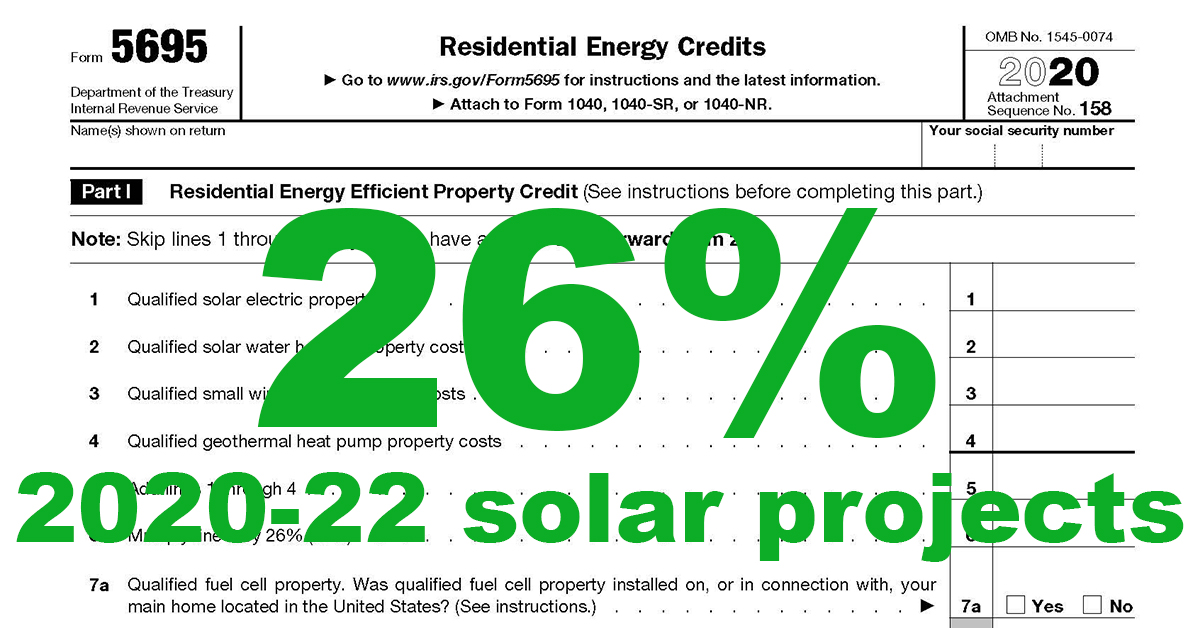

Verkko 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit How to Claim the Credit File Form 5695 Residential Energy Credits Part II with your tax return You must claim the credit for the tax year when the improvement is installed not purchased

Federal Energy Tax Credit For Air Conditioners have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Modifications: The Customization feature lets you tailor printables to fit your particular needs, whether it's designing invitations and schedules, or decorating your home.

-

Educational Use: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them a great source for educators and parents.

-

The convenience of Fast access a myriad of designs as well as templates reduces time and effort.

Where to Find more Federal Energy Tax Credit For Air Conditioners

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Verkko Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is

Verkko 30 jouluk 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce energy costs while reducing demand as we transition

We hope we've stimulated your interest in Federal Energy Tax Credit For Air Conditioners we'll explore the places the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with Federal Energy Tax Credit For Air Conditioners for all goals.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a broad array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Federal Energy Tax Credit For Air Conditioners

Here are some innovative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Federal Energy Tax Credit For Air Conditioners are an abundance with useful and creative ideas for a variety of needs and interests. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the vast array of Federal Energy Tax Credit For Air Conditioners now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can print and download these materials for free.

-

Can I utilize free printables in commercial projects?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with Federal Energy Tax Credit For Air Conditioners?

- Some printables could have limitations on use. Check the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using an printer, or go to a local print shop to purchase higher quality prints.

-

What program do I need to run printables free of charge?

- The majority are printed in PDF format, which can be opened with free software such as Adobe Reader.

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

Florida Energy Rebates For Air Conditioners 300 Federal Tax Credit

Check more sample of Federal Energy Tax Credit For Air Conditioners below

Federal Energy Property Tax Credits Reinstated HB McClure

Puget Sound Solar LLC

Is Your Air Conditioner Eligible For A 300 Federal Tax Credit Tax

Solar Tax Credits Solar Tribune

Products At True North Home Comfort

Do Air Conditioners Qualify For Residential Energy Credit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Verkko 25 lokak 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

https://www.irs.gov/credits-deductions/energy-efficient-home...

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Verkko 25 lokak 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Solar Tax Credits Solar Tribune

Puget Sound Solar LLC

Products At True North Home Comfort

Do Air Conditioners Qualify For Residential Energy Credit

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

Energy Subcommittee Examines Federal Energy Tax Policy Daily Energy

Energy Subcommittee Examines Federal Energy Tax Policy Daily Energy

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act