In this day and age with screens dominating our lives and the appeal of physical printed material hasn't diminished. In the case of educational materials in creative or artistic projects, or simply adding an element of personalization to your space, House Rent Paid Deduction Under Income Tax have become an invaluable resource. We'll dive deeper into "House Rent Paid Deduction Under Income Tax," exploring what they are, where they are available, and how they can enrich various aspects of your daily life.

Get Latest House Rent Paid Deduction Under Income Tax Below

House Rent Paid Deduction Under Income Tax

House Rent Paid Deduction Under Income Tax - House Rent Paid Deduction Under Income Tax, House Rent Paid Deduction In Income Tax, House Rent Allowance Deduction In Income Tax, House Rent Allowance Deduction In Income Tax Section, House Rent Received Deduction In Income Tax, House Rent Received Deduction In Income Tax Section, House Rent Paid Rebate In Income Tax, House Rent Allowance Rebate In Income Tax, Deduction From House Rent Income, Deduction For House Rent Paid

Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable

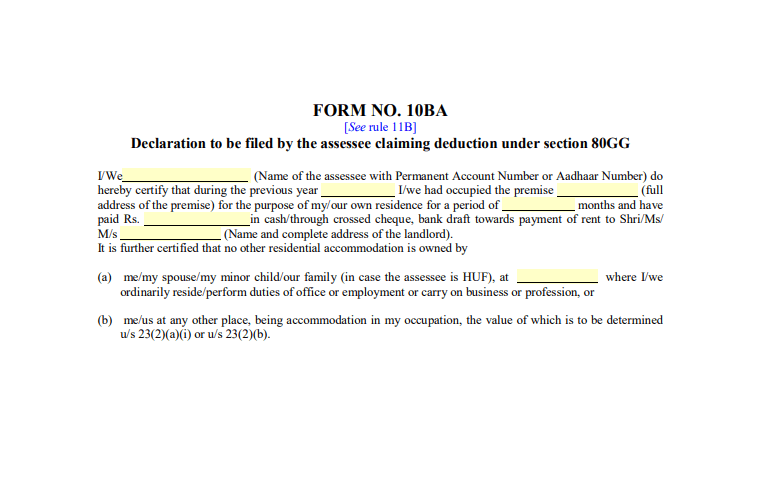

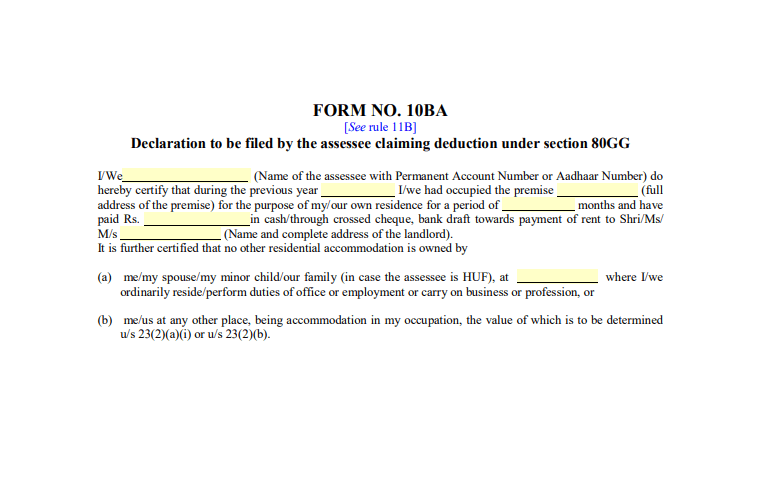

Under Section 80GG of the Indian Income Tax Act 1961 any individual no Companies can claim a deduction on the rent they pay for their accommodation To claim the

Printables for free include a vast selection of printable and downloadable materials available online at no cost. These resources come in various formats, such as worksheets, templates, coloring pages and more. The value of House Rent Paid Deduction Under Income Tax is in their variety and accessibility.

More of House Rent Paid Deduction Under Income Tax

Deduction Under Income Tax Lex N Tax Associates

Deduction Under Income Tax Lex N Tax Associates

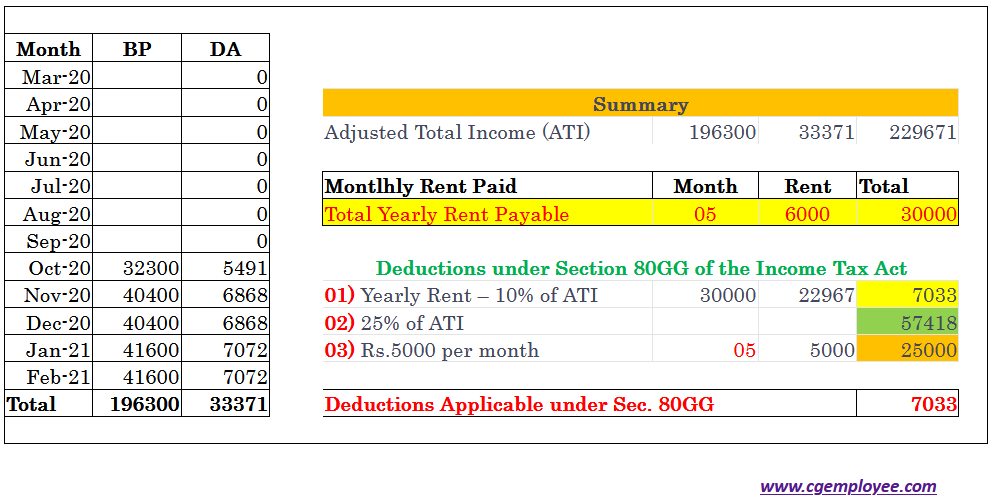

Taxpayers can claim an income tax deduction for any amount paid as rent under Section 80GG of the Income Tax Act Section 80GG is a facility introduced in the Act for providing a tax deduction to taxpayers who are not

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is permissible subject to the following conditions

House Rent Paid Deduction Under Income Tax have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor printed materials to meet your requirements for invitations, whether that's creating them and schedules, or even decorating your home.

-

Educational Benefits: Education-related printables at no charge provide for students of all ages, making them a valuable source for educators and parents.

-

An easy way to access HTML0: The instant accessibility to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more House Rent Paid Deduction Under Income Tax

HRA Calculation In Salary How To Claim Rent Paid Deduction 80GG

HRA Calculation In Salary How To Claim Rent Paid Deduction 80GG

If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted under Section 80

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

If we've already piqued your curiosity about House Rent Paid Deduction Under Income Tax We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of goals.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs covered cover a wide spectrum of interests, everything from DIY projects to party planning.

Maximizing House Rent Paid Deduction Under Income Tax

Here are some inventive ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

House Rent Paid Deduction Under Income Tax are an abundance with useful and creative ideas that meet a variety of needs and needs and. Their availability and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the endless world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes they are! You can print and download these resources at no cost.

-

Are there any free printables to make commercial products?

- It's all dependent on the usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables may be subject to restrictions on use. Be sure to check these terms and conditions as set out by the designer.

-

How can I print House Rent Paid Deduction Under Income Tax?

- Print them at home with either a printer at home or in a local print shop to purchase top quality prints.

-

What software do I require to view printables that are free?

- The majority of printables are in PDF format, which is open with no cost programs like Adobe Reader.

80GG Deduction Under Income Tax Rent Paid HRA Deduction How To

Rent Paid Deduction In Hindi

Check more sample of House Rent Paid Deduction Under Income Tax below

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

80GG Rent Paid Deduction Every Businessman Saves Tax shorts YouTube

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

Department Rep Meeting Auditor

https://tax2win.in/guide/claim-deduction-under...

Under Section 80GG of the Indian Income Tax Act 1961 any individual no Companies can claim a deduction on the rent they pay for their accommodation To claim the

https://www.caclubindia.com/guide/80g…

Section 80GG deduction is available under Chapter VI A which provides tax relief to individuals who incur expenses on rent for their accommodation but do not receive House Rent Allowance

Under Section 80GG of the Indian Income Tax Act 1961 any individual no Companies can claim a deduction on the rent they pay for their accommodation To claim the

Section 80GG deduction is available under Chapter VI A which provides tax relief to individuals who incur expenses on rent for their accommodation but do not receive House Rent Allowance

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

80GG Rent Paid Deduction Every Businessman Saves Tax shorts YouTube

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

Department Rep Meeting Auditor

Deductions Under Income Tax Act

Income Tax Deduction Under 80C Lex N Tax Associates

Income Tax Deduction Under 80C Lex N Tax Associates

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube