In this age of electronic devices, with screens dominating our lives however, the attraction of tangible printed products hasn't decreased. For educational purposes or creative projects, or just adding an element of personalization to your home, printables for free are a great source. Here, we'll take a dive into the world "Income Tax Exemption For Salaried Employees," exploring what they are, where to find them and how they can improve various aspects of your life.

Get Latest Income Tax Exemption For Salaried Employees Below

Income Tax Exemption For Salaried Employees

Income Tax Exemption For Salaried Employees - Income Tax Exemption For Salaried Employees Pdf, Income Tax Exemption For Salaried Employees, Income Tax Exemption For Salaried Employees Calculator, Income Tax Exemption For Salaried Employees 2021-22, Income Tax Exemptions For Salaried Employees 2022-23, Income Tax Exemptions For Salaried Employees 2022-23 Pdf, Income Tax Exemptions For Salaried Employees 2020-21, Income Tax Exemptions For Salaried Employees Ay 2023-24, Income Tax Exemptions For Salaried Employees Ay 2022-23, Income Tax Exemptions For Salaried Employees 2024-25

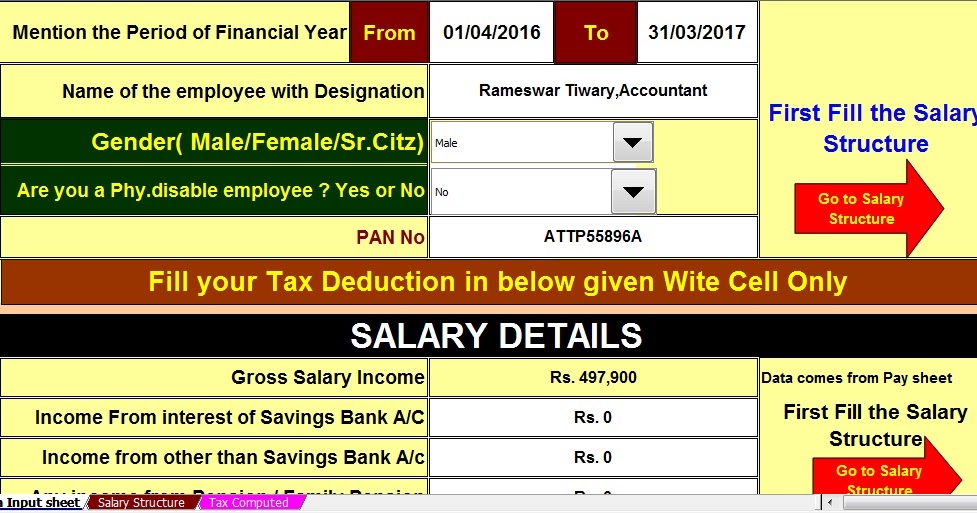

Income Tax Slab for Salaried Person Below 60 Years of Age and HUF FY 2023 24 AY 2024 25 Plan your taxes for the current financial year 2023 24 and check out the revised income tax slabs and benefits for the salaried taxpayers under the new tax regime here Income Tax Slabs for Salaried Person and HUF for FY 2023 24 New Tax Regime

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative

Income Tax Exemption For Salaried Employees provide a diverse assortment of printable, downloadable materials that are accessible online for free cost. These printables come in different formats, such as worksheets, templates, coloring pages and more. The attraction of printables that are free is their versatility and accessibility.

More of Income Tax Exemption For Salaried Employees

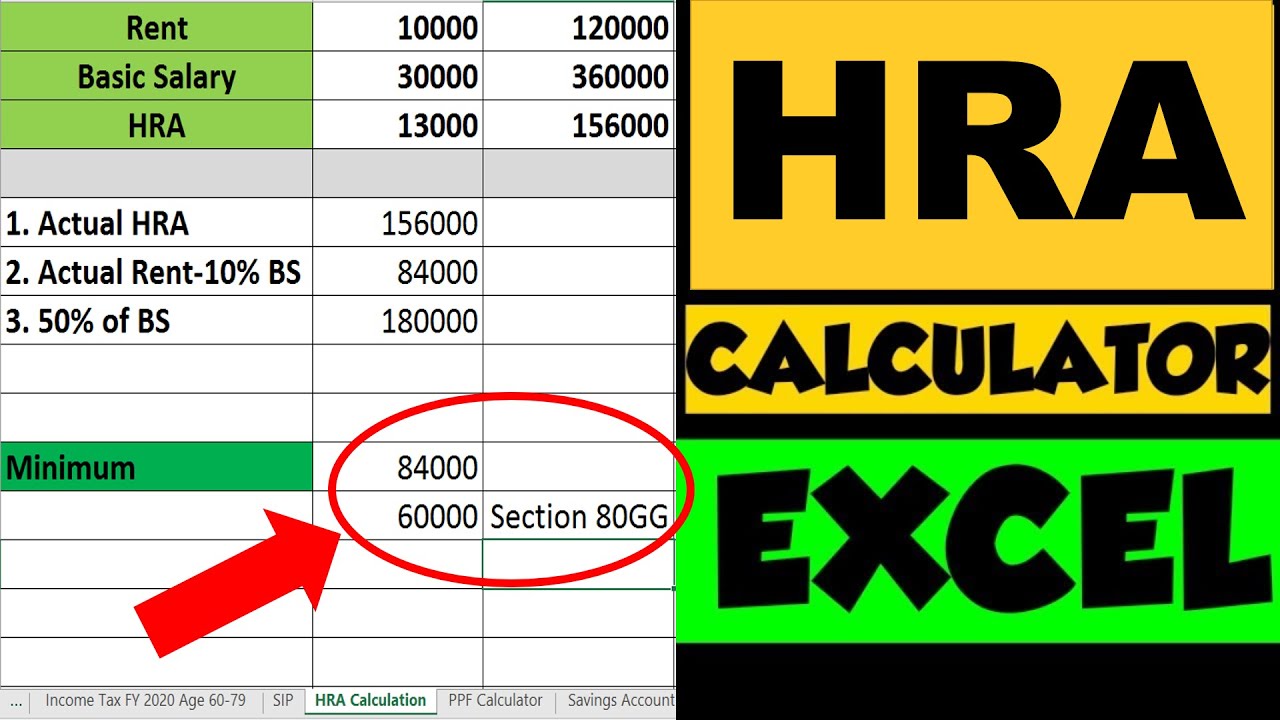

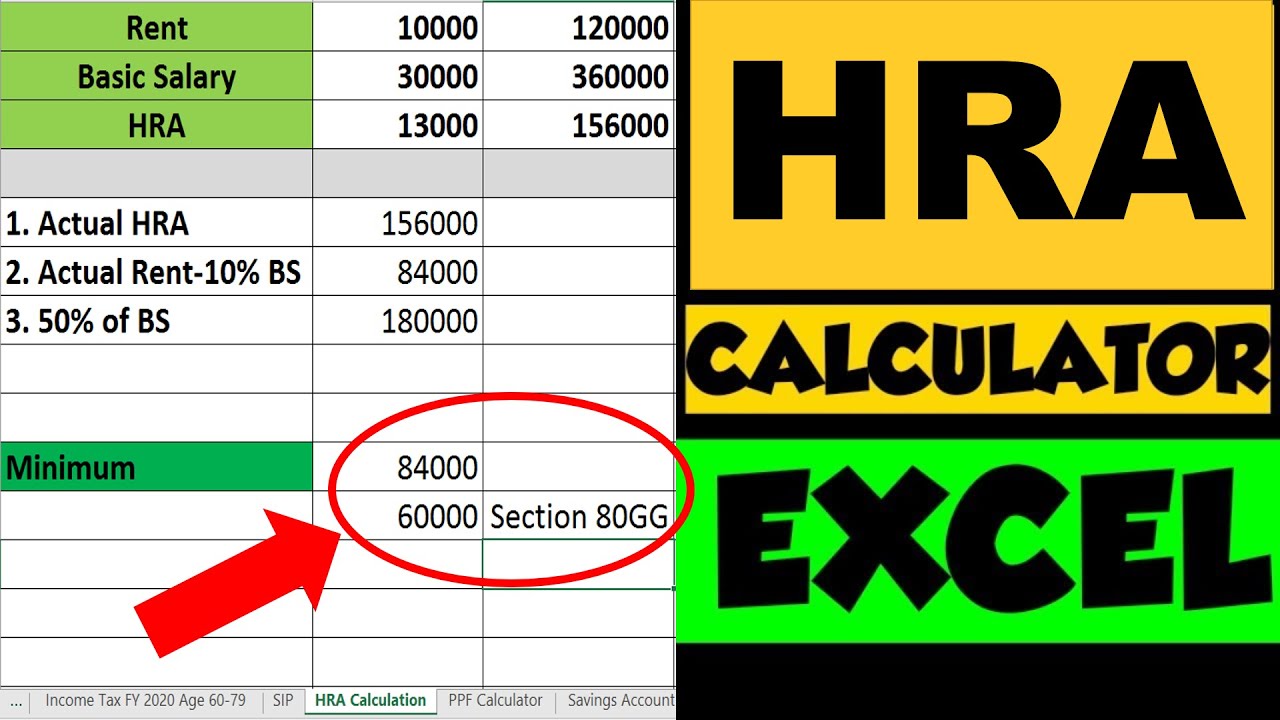

HRA Exemption Excel Calculator For Salaried Employees House Rent

HRA Exemption Excel Calculator For Salaried Employees House Rent

The document provides valuable insights into the income tax benefits available to salaried individuals for the assessment year AY 2024 25 and document includes brief introduction and tax treatment of various allowances and perquisites available to an employee inter alia house rent allowance gratuity provident fund and so forth

11 min read The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about those exemption provisions and the terms and conditions on which one can avail a tax exemption Here s more on this matter What Is Section 10 Of Income Tax Act

Income Tax Exemption For Salaried Employees have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: They can make printables to your specific needs for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Benefits: Education-related printables at no charge provide for students of all ages, making them an invaluable resource for educators and parents.

-

The convenience of Fast access many designs and templates is time-saving and saves effort.

Where to Find more Income Tax Exemption For Salaried Employees

Allowances Exemptions And Deductions Under Income Tax Act For Salaried

Allowances Exemptions And Deductions Under Income Tax Act For Salaried

Income Tax Exemption for Salaried Employees All You Need to Know about Leave Travel Allowance LTA It is important for salaried employees to know the deductions available while filing their income tax returns Know More about Leave Travel Allowance LTA here By Manu Sharma On April 6 2024 10 48 am 2 mins read

Updated on Apr 15th 2024 19 min read Salaried taxpayers primarily earn their income from salary The salaried are normally offered a salary package or CTC cost to company The taxability of the salary income is determined by the employer The employer also deducts a tax TDS on the salary paid to them

If we've already piqued your curiosity about Income Tax Exemption For Salaried Employees and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Exemption For Salaried Employees for various needs.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a broad range of topics, from DIY projects to party planning.

Maximizing Income Tax Exemption For Salaried Employees

Here are some creative ways for you to get the best of Income Tax Exemption For Salaried Employees:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Exemption For Salaried Employees are a treasure trove of fun and practical tools that meet a variety of needs and desires. Their availability and versatility make them a valuable addition to your professional and personal life. Explore the plethora of Income Tax Exemption For Salaried Employees right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can download and print the resources for free.

-

Can I download free printables in commercial projects?

- It's contingent upon the specific usage guidelines. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables could be restricted on usage. Always read the terms and conditions set forth by the author.

-

How do I print Income Tax Exemption For Salaried Employees?

- Print them at home with your printer or visit the local print shop for better quality prints.

-

What program do I require to view printables for free?

- The majority of printed documents are with PDF formats, which is open with no cost software, such as Adobe Reader.

Home Loan Apply Online For Housing Loan With HHFL

CBDT Increases Income Tax Exemption Limit On Leave Encashment For Non

Check more sample of Income Tax Exemption For Salaried Employees below

How To File Income Tax Return ITR Online For Salaried Employees

Salaried Employees Alert Income Tax Exemption Limit Likely To Be

How To Save Income Tax For Salaried Employees

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

How To Reduce Your Small Business Tax Bill Small Business Tax Income

How To File Income Tax Return Online For Salaried Employees 2022 2023

https://www. incometax.gov.in /iec/foportal/help/...

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative

https:// incometaxindia.gov.in /Tutorials/80...

Allowances are generally fixed irrespective of actual expenditure and are taxable Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is paid in addition to or in lieu of salary However some exemptions are

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative

Allowances are generally fixed irrespective of actual expenditure and are taxable Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is paid in addition to or in lieu of salary However some exemptions are

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

Salaried Employees Alert Income Tax Exemption Limit Likely To Be

How To Reduce Your Small Business Tax Bill Small Business Tax Income

How To File Income Tax Return Online For Salaried Employees 2022 2023

6 Income Tax Exemption For Salaried Persons As Per Budget 2016 With

Monthly Tax Deduction Malaysia Tax Is Generally Payable In 12 Monthly

Monthly Tax Deduction Malaysia Tax Is Generally Payable In 12 Monthly

How To File Income Tax Return Online For Salaried Employee Alankit