In this day and age where screens rule our lives however, the attraction of tangible printed items hasn't gone away. No matter whether it's for educational uses as well as creative projects or simply to add an extra personal touch to your space, Income Tax Rebate On Salary Arrears have become a valuable source. We'll dive into the world "Income Tax Rebate On Salary Arrears," exploring what they are, where they are available, and how they can enrich various aspects of your daily life.

Get Latest Income Tax Rebate On Salary Arrears Below

Income Tax Rebate On Salary Arrears

Income Tax Rebate On Salary Arrears - Income Tax Rebate On Salary Arrears, Income Tax Relief On Salary Arrears, Salary Arrears In Itr, How Can I Show Arrears Of Salary In Itr, Is Arrears Of Salary Taxable, How To Show Arrears Of Salary In Itr, How Are Arrears Of Salary Taxed

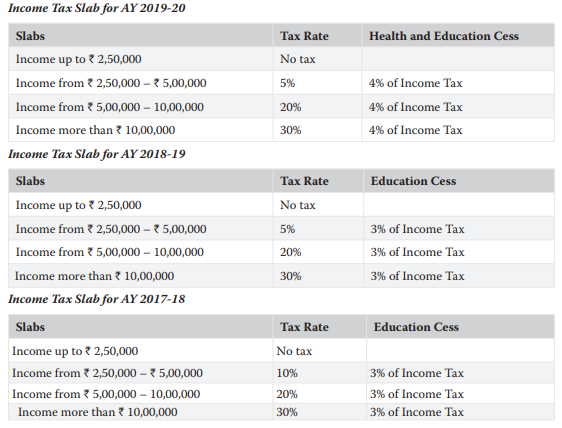

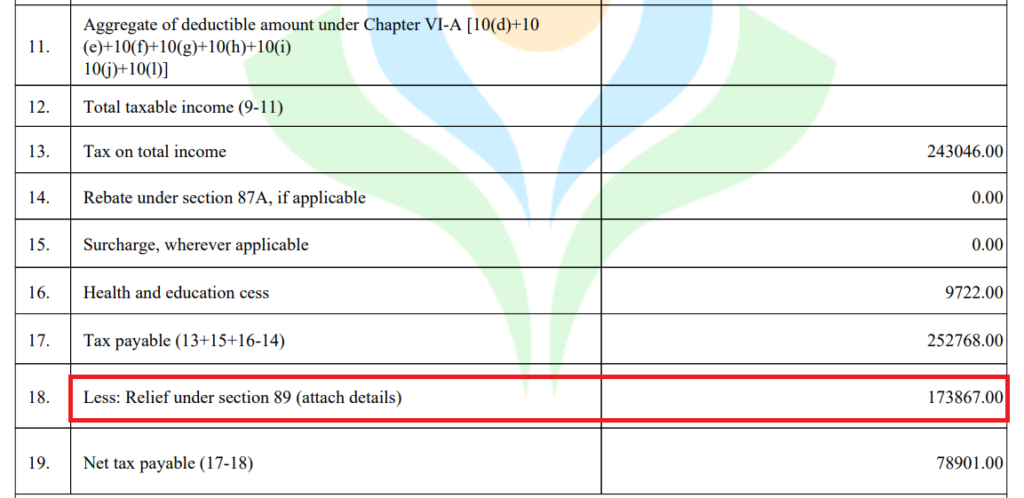

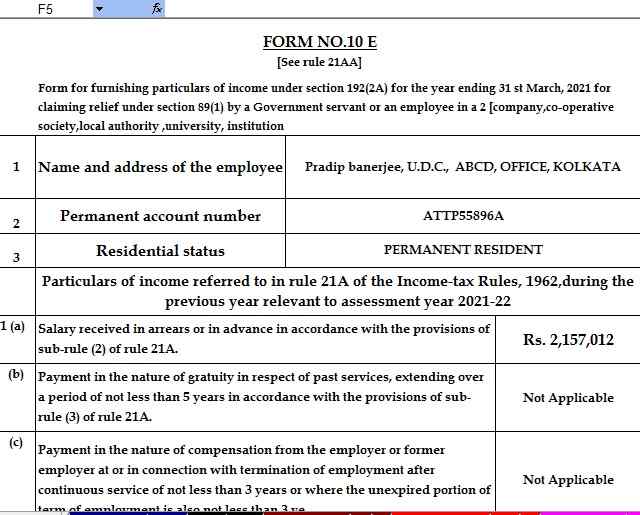

Web 8 f 233 vr 2022 nbsp 0183 32 If your total income includes any past dues paid in the current financial year you may be worried about paying a higher tax on such arrears Hence in order to

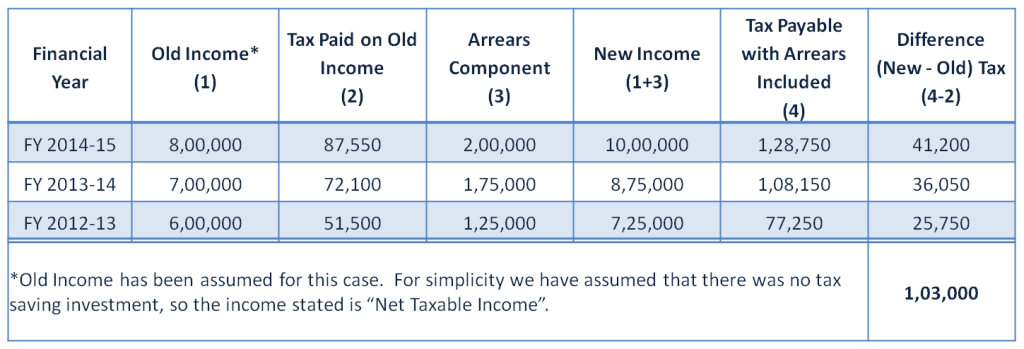

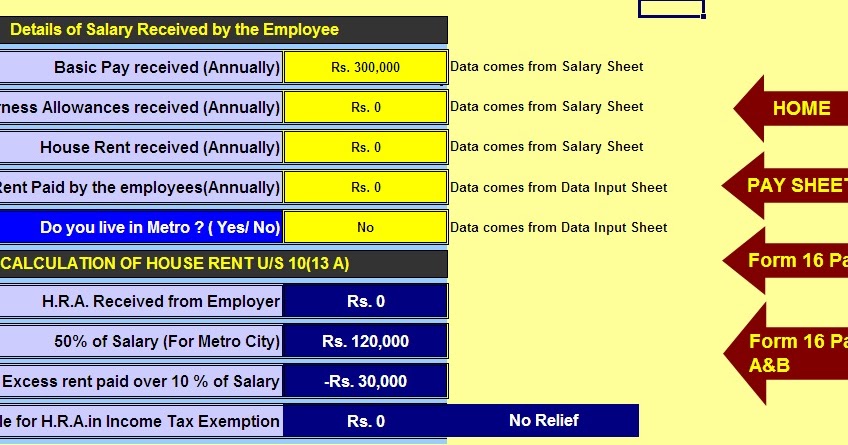

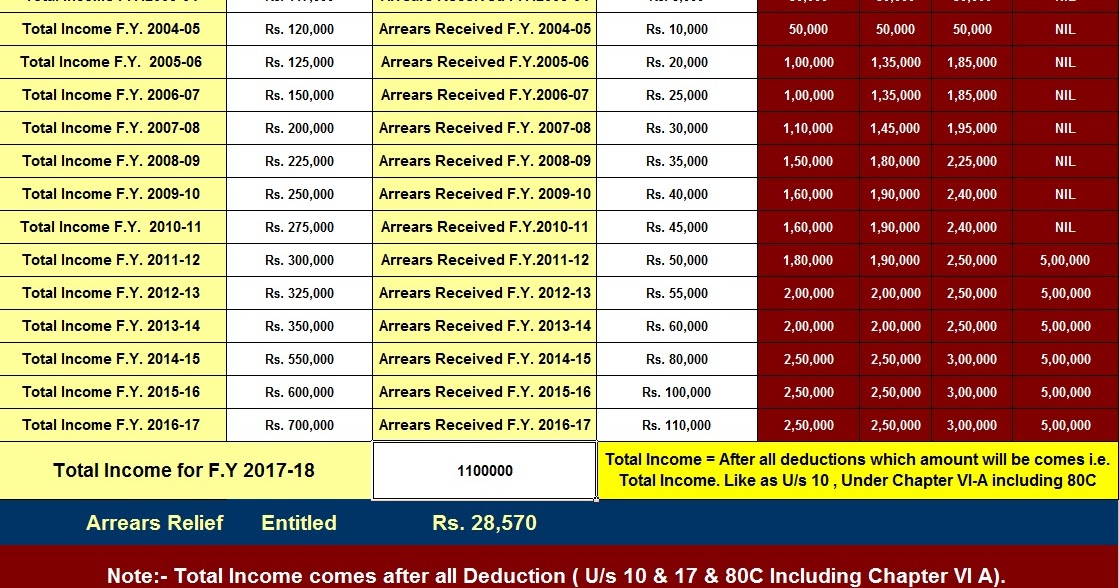

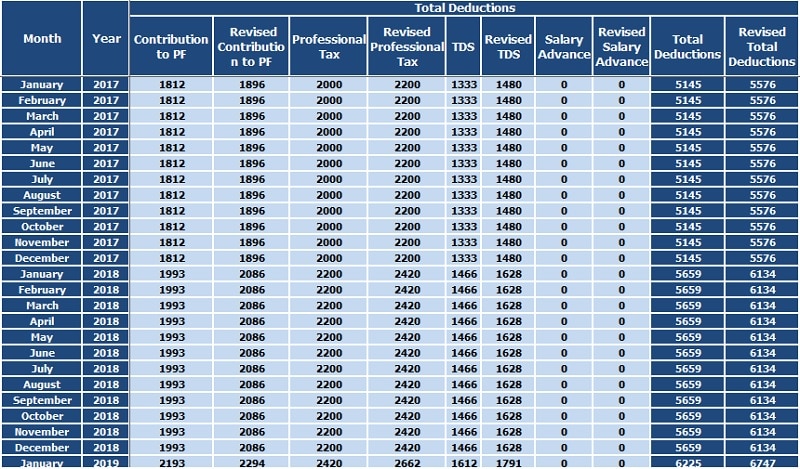

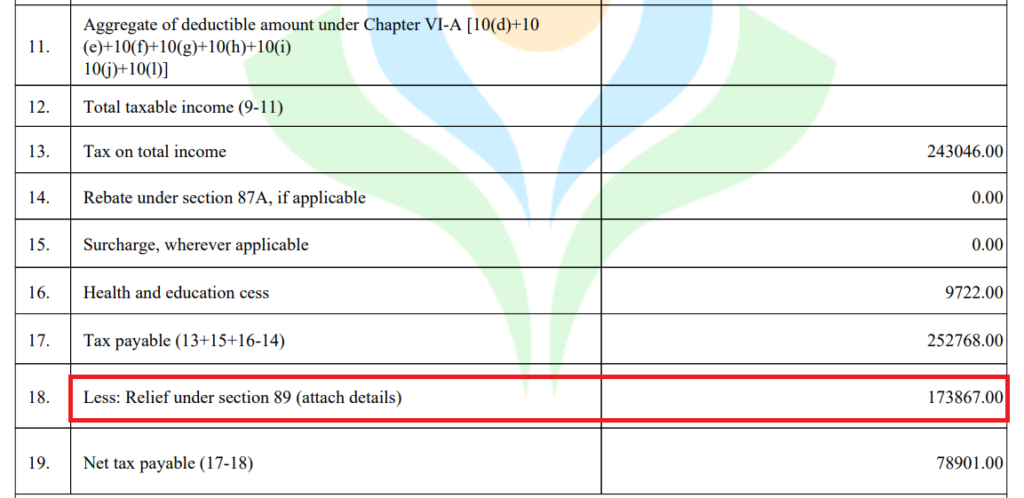

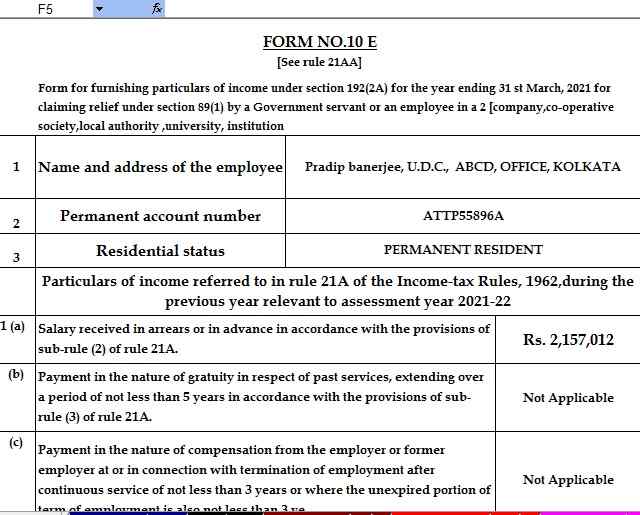

Web How to Calculate Tax Relief under Section 89 1 on Salary Arrears 1 Calculate tax payable on the total income including additional salary arrears or compensations in the year it is received 2 Calculate tax

Income Tax Rebate On Salary Arrears encompass a wide variety of printable, downloadable items that are available online at no cost. They come in many formats, such as worksheets, coloring pages, templates and more. The beauty of Income Tax Rebate On Salary Arrears is their versatility and accessibility.

More of Income Tax Rebate On Salary Arrears

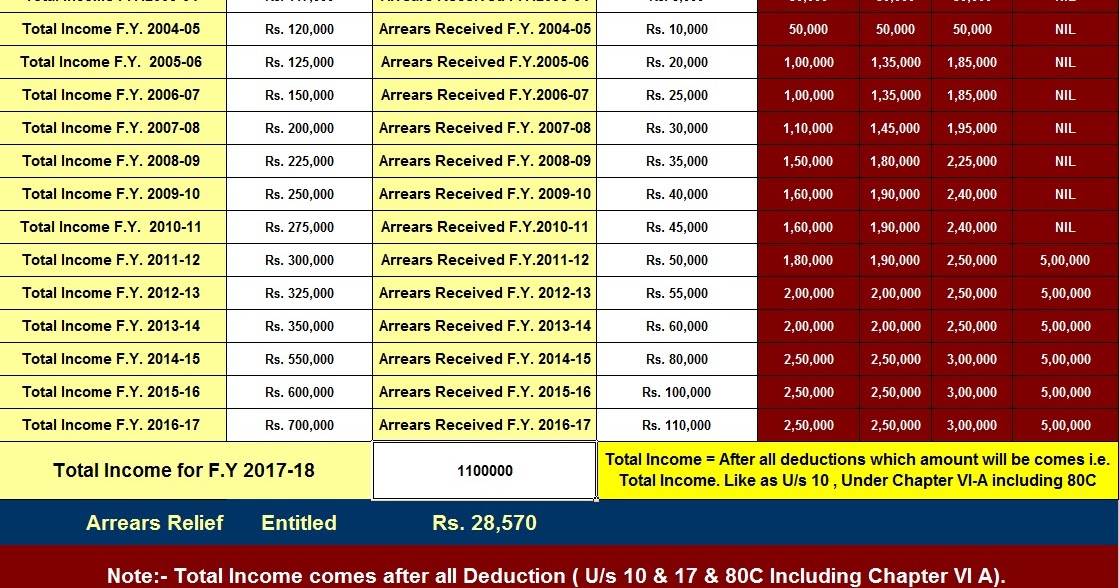

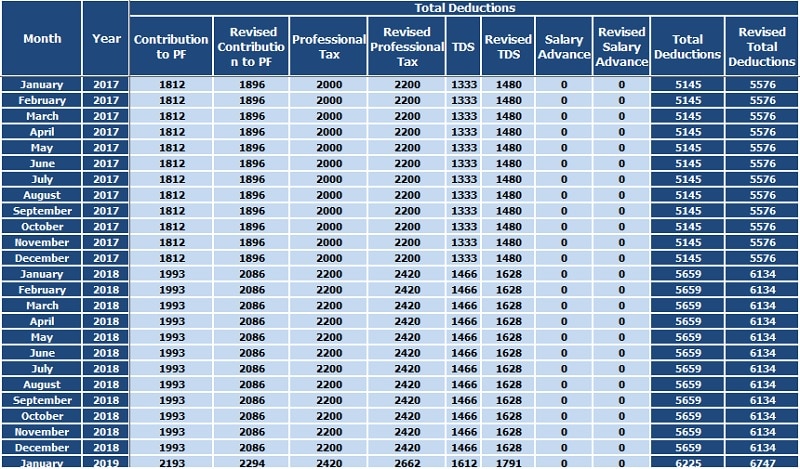

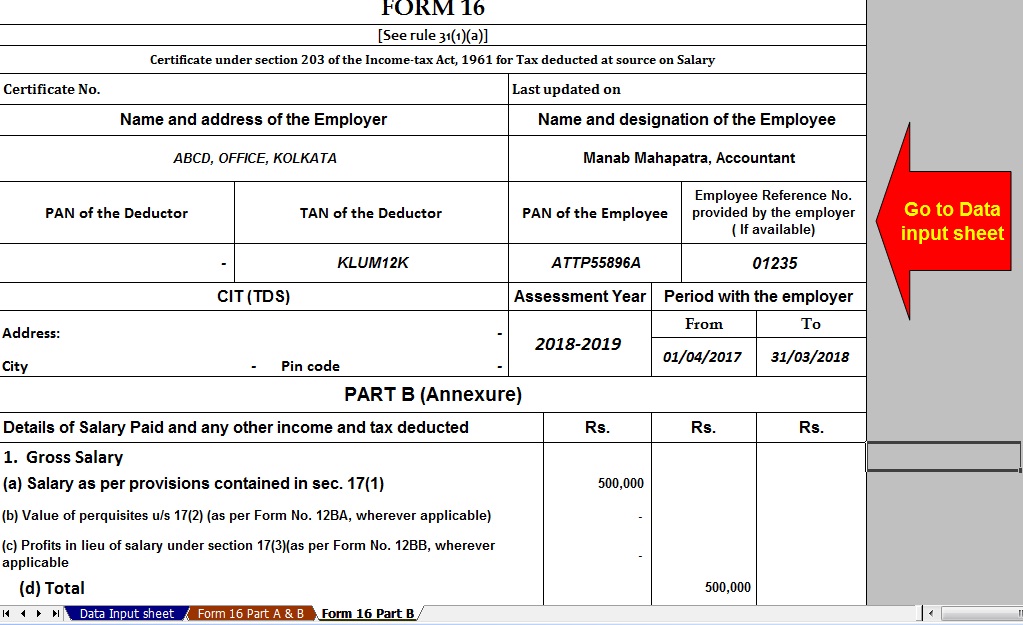

Download Salary Arrears Calculator Excel Template ExcelDataPro

Download Salary Arrears Calculator Excel Template ExcelDataPro

Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is

Web Bank Employees may claim the Income Tax relief on Arrears paid from 01 Nov 2012 after submitting the Form 10 E which can easily be automatically generated with the help of this calculator including the Income Tax

Income Tax Rebate On Salary Arrears have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: This allows you to modify print-ready templates to your specific requirements such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: These Income Tax Rebate On Salary Arrears are designed to appeal to students of all ages. This makes them a useful source for educators and parents.

-

An easy way to access HTML0: You have instant access numerous designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Salary Arrears

TAX BY MANISH Save Tax On Salary Arrears Tax Relief Calculations U s

TAX BY MANISH Save Tax On Salary Arrears Tax Relief Calculations U s

Web 5 avr 2023 nbsp 0183 32 However one can claim relief under section 89 1 for arrears of salary or advance salary if the Rate of tax on salary in the current year is more than the rate of

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous

Since we've got your interest in Income Tax Rebate On Salary Arrears Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Income Tax Rebate On Salary Arrears for a variety objectives.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free with flashcards and other teaching materials.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing Income Tax Rebate On Salary Arrears

Here are some fresh ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate On Salary Arrears are an abundance of useful and creative resources that cater to various needs and preferences. Their accessibility and flexibility make them a great addition to your professional and personal life. Explore the vast collection of Income Tax Rebate On Salary Arrears right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can download and print these documents for free.

-

Can I use free printouts for commercial usage?

- It's based on specific rules of usage. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables could have limitations in their usage. Be sure to check the conditions and terms of use provided by the creator.

-

How do I print Income Tax Rebate On Salary Arrears?

- Print them at home using either a printer at home or in a print shop in your area for higher quality prints.

-

What program will I need to access Income Tax Rebate On Salary Arrears?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software like Adobe Reader.

How To Calculate Tax On Arrears U s 89 1 Show It In ITR

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

Check more sample of Income Tax Rebate On Salary Arrears below

INCOME TAX ON SALARY ARREARS RELIEF UNDER 89 1 SIMPLE TAX INDIA

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

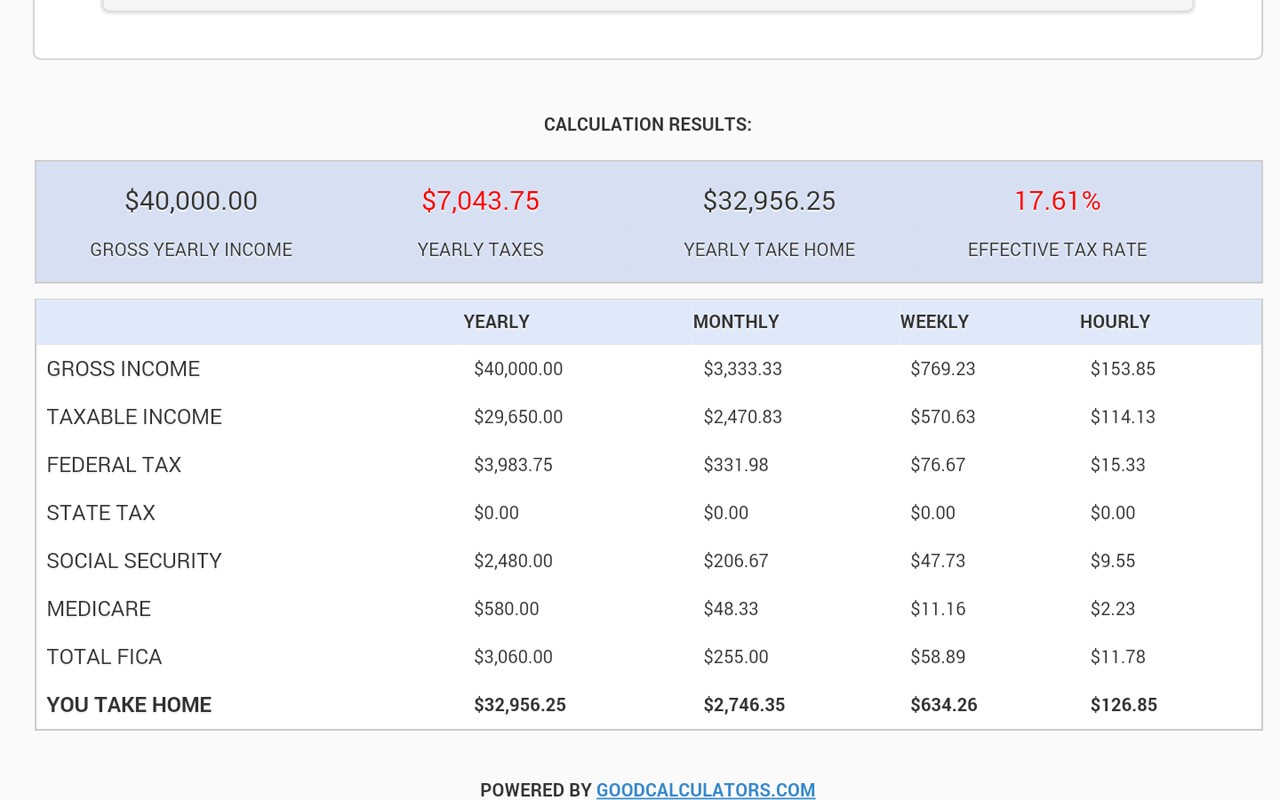

United States Salary Tax Calculator

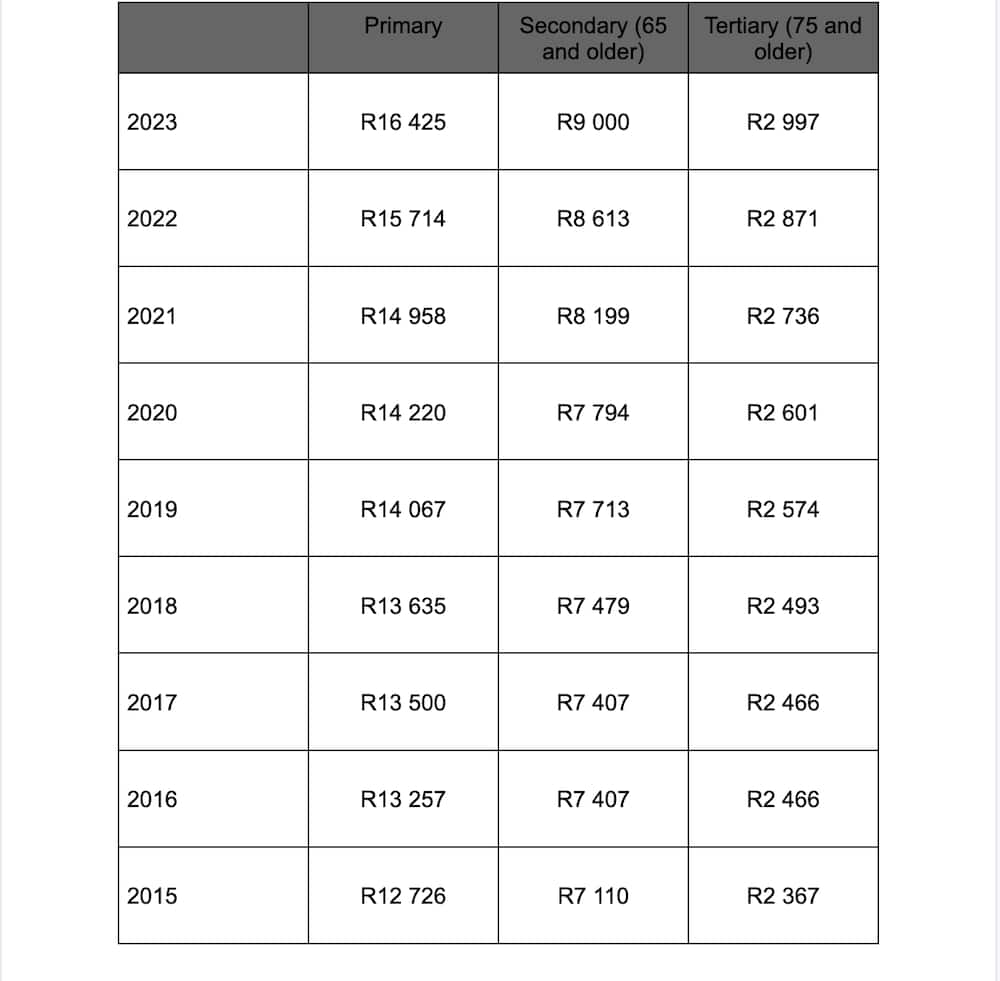

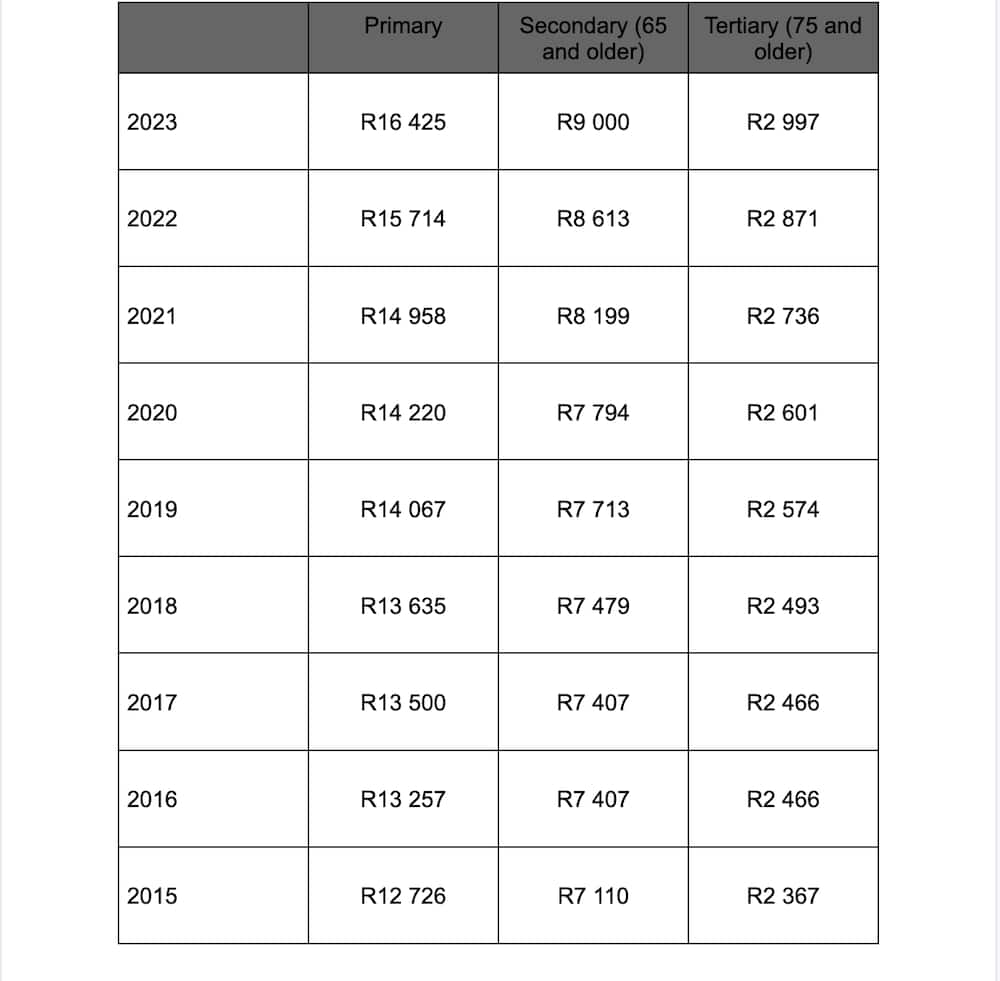

How To Calculate PAYE On Salary 2022 Step by step Guide Briefly co za

Automated Excel Form 10 E Salary Arrears Relief Calculator For Claiming

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://www.canarahsbclife.com/tax-university…

Web How to Calculate Tax Relief under Section 89 1 on Salary Arrears 1 Calculate tax payable on the total income including additional salary arrears or compensations in the year it is received 2 Calculate tax

https://taxguru.in/income-tax/section-89-tax-relief-salary-arrears...

Web 26 ao 251 t 2021 nbsp 0183 32 As per Section 89 1 tax deduction relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertain and the

Web How to Calculate Tax Relief under Section 89 1 on Salary Arrears 1 Calculate tax payable on the total income including additional salary arrears or compensations in the year it is received 2 Calculate tax

Web 26 ao 251 t 2021 nbsp 0183 32 As per Section 89 1 tax deduction relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertain and the

How To Calculate PAYE On Salary 2022 Step by step Guide Briefly co za

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

Automated Excel Form 10 E Salary Arrears Relief Calculator For Claiming

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Claim Income Tax Relief Under Section 89 1 On Salary Arrears

Claim Income Tax Relief Under Section 89 1 On Salary Arrears

Download Automated Tax Computed Sheet HRA Calculation Arrears