In this age of technology, in which screens are the norm however, the attraction of tangible printed products hasn't decreased. If it's to aid in education, creative projects, or just adding personal touches to your area, Mortgage Loan Rebate In Income Tax are now an essential resource. This article will dive into the sphere of "Mortgage Loan Rebate In Income Tax," exploring what they are, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Mortgage Loan Rebate In Income Tax Below

Mortgage Loan Rebate In Income Tax

Mortgage Loan Rebate In Income Tax - Mortgage Loan Rebate In Income Tax, Home Loan Rebate In Income Tax, Home Loan Rebate In Income Tax 2022-23, Home Loan Rebate In Income Tax Section, Home Loan Rebate In Income Tax New Regime, Home Loan Rebate In Income Tax 2021-22, Home Loan Rebate In Income Tax Limit, Home Loan Rebate In Income Tax Before Possession, Home Loan Rebate In Income Tax Rule, Home Loan Rebate In Income Tax India

Web 19 janv 2023 nbsp 0183 32 Income tax Updated 19 Jan 2023 Buy to let mortgage interest tax relief explained Changes to tax relief rules mean some landlords face higher bills We explain what the changes mean for you

Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

Mortgage Loan Rebate In Income Tax cover a large range of printable, free documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and more. The benefit of Mortgage Loan Rebate In Income Tax is their versatility and accessibility.

More of Mortgage Loan Rebate In Income Tax

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Web 1 sept 2023 nbsp 0183 32 In a nutshell yes If you have a home loan the mortgage interest deduction allows you to reduce your taxable income by the

Web 5 f 233 vr 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Mortgage Loan Rebate In Income Tax have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: You can tailor the design to meet your needs for invitations, whether that's creating them to organize your schedule or decorating your home.

-

Educational Use: Downloads of educational content for free are designed to appeal to students of all ages, making them an invaluable aid for parents as well as educators.

-

Easy to use: immediate access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Mortgage Loan Rebate In Income Tax

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Web If your are an owner occupant of a property in the Netherlands you can get part of the financing costs refunded The rules for the refund are gradually changing over the year

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax

Now that we've ignited your curiosity about Mortgage Loan Rebate In Income Tax Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Mortgage Loan Rebate In Income Tax for various purposes.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Mortgage Loan Rebate In Income Tax

Here are some inventive ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Mortgage Loan Rebate In Income Tax are an abundance of practical and imaginative resources that satisfy a wide range of requirements and preferences. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the wide world of Mortgage Loan Rebate In Income Tax today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can download and print these documents for free.

-

Does it allow me to use free printables in commercial projects?

- It's all dependent on the terms of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with Mortgage Loan Rebate In Income Tax?

- Some printables may have restrictions regarding their use. Be sure to read the conditions and terms of use provided by the author.

-

How can I print Mortgage Loan Rebate In Income Tax?

- Print them at home with a printer or visit an area print shop for more high-quality prints.

-

What program do I need in order to open printables for free?

- The majority are printed in the format PDF. This can be opened using free software like Adobe Reader.

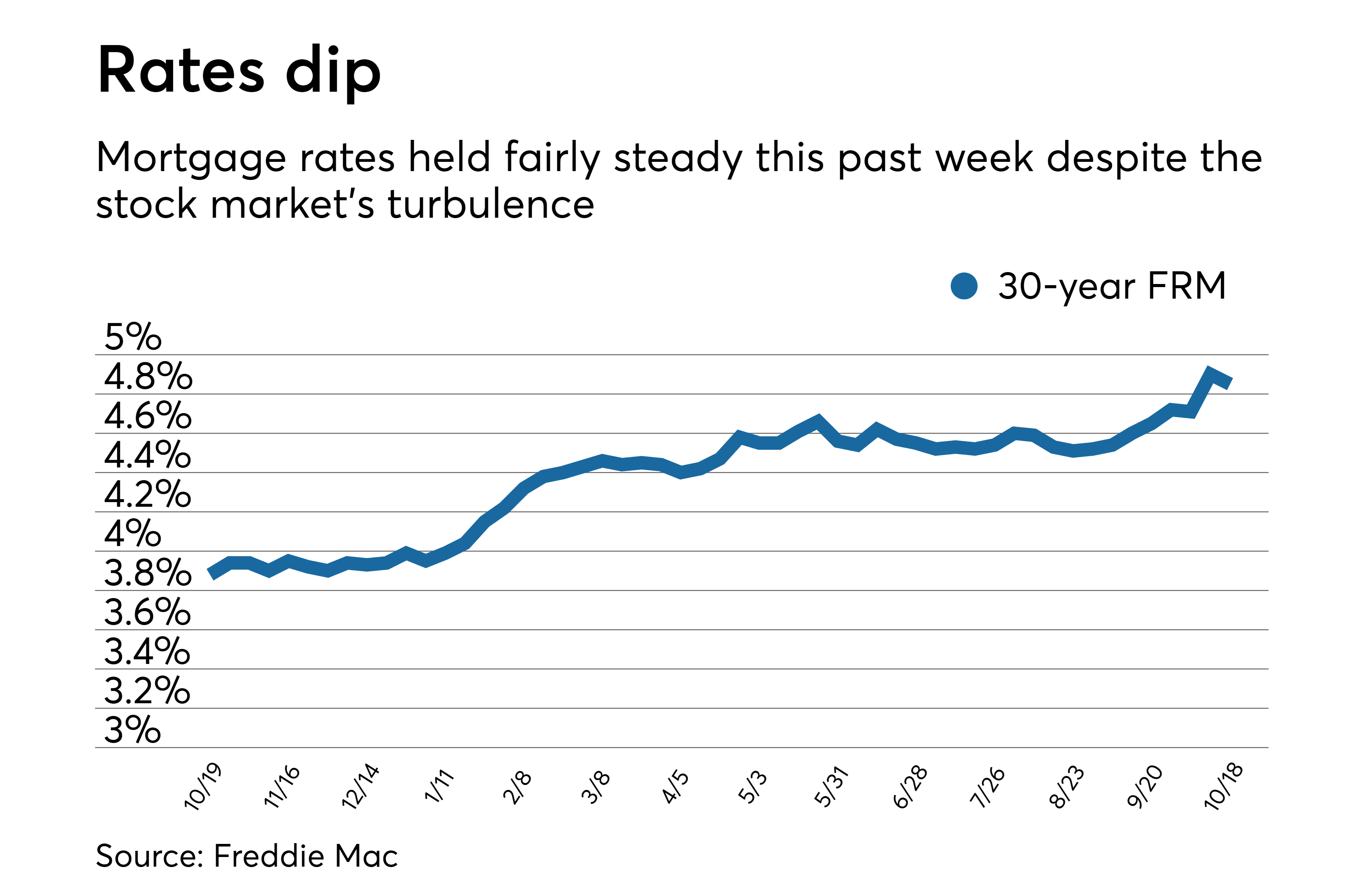

Average Mortgage Rates Decline At Least For One Week National

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Check more sample of Mortgage Loan Rebate In Income Tax below

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Rebate On Home Loan Fy 2019 20 A design system

BB BlackBerry Limited Short Interest And Earnings Date Annual Report

Home Loan Tax Benefits In India Important Facts

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

IVR Invesco Mortgage Capital Short Interest And Earnings Date Annual

https://www.thebalancemoney.com/home-mortgage-interest-tax-deductio…

Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

Home Loan Tax Benefits In India Important Facts

Income Tax Rebate On Home Loan Fy 2019 20 A design system

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

IVR Invesco Mortgage Capital Short Interest And Earnings Date Annual

DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Advantages Of Limited Partnerships

Tax Advantages Of Limited Partnerships

Lowest Fixed Rate Home Loans Singapore Sep 2017