In this day and age in which screens are the norm it's no wonder that the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes and creative work, or just adding an individual touch to your space, Is Medical Reimbursement Taxable have become a valuable resource. The following article is a dive into the world "Is Medical Reimbursement Taxable," exploring their purpose, where to get them, as well as how they can enrich various aspects of your life.

Get Latest Is Medical Reimbursement Taxable Below

Is Medical Reimbursement Taxable

Is Medical Reimbursement Taxable - Is Medical Reimbursement Taxable, Is Medical Reimbursement Taxable Income, Is Medical Reimbursement Taxable In India, Is Medical Reimbursement Taxable For Central Government Employees, Is Medical Reimbursement Taxable In New Tax Regime, Is Medical Reimbursement Taxable Or Not, Is Medical Reimbursement Taxable For Pensioners, Is Medical Reimbursement Taxable In Singapore, Are Reimbursement Taxable, Is Medical Expenses Reimbursement Taxable

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in most cases aren t included in your income For 2022 health FSAs are subject to a 2 850 limit on a salary reduction contribution Health

In case of salaried person who is provided with medical allowance the whole amount will be taxable The medical facility in India provided to the employee or his dependent relative i e children spouse brothers sister and parents by his employer will not be chargeable to tax to the extent of the following

Is Medical Reimbursement Taxable provide a diverse range of downloadable, printable items that are available online at no cost. They come in many styles, from worksheets to templates, coloring pages and many more. The benefit of Is Medical Reimbursement Taxable is their flexibility and accessibility.

More of Is Medical Reimbursement Taxable

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

What Are Employee Expense Reimbursements and Are They Taxable Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans Moses Balian Jul 28 2023 4 minutes Table of Contents

Employers are allowed to claim a tax deduction for the reimbursements they make through these plans and reimbursement dollars received by employees are generally tax free Key Takeaways HRAs

The Is Medical Reimbursement Taxable have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize printing templates to your own specific requirements for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational Use: Education-related printables at no charge provide for students from all ages, making these printables a powerful tool for parents and teachers.

-

An easy way to access HTML0: immediate access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Is Medical Reimbursement Taxable

Is Tuition Reimbursement Taxable A Guide ClearDegree

Is Tuition Reimbursement Taxable A Guide ClearDegree

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

Is an HRA reimbursement taxable Under Internal Revenue Service IRS rules 1 employers can reimburse their employees for health insurance and qualifying medical expenses in a tax advantaged way The most prominent vehicle for doing so is an HRA When an HRA complies with federal rules employers can

After we've peaked your curiosity about Is Medical Reimbursement Taxable Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Is Medical Reimbursement Taxable suitable for many purposes.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Great for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing Is Medical Reimbursement Taxable

Here are some ideas to make the most use of Is Medical Reimbursement Taxable:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is Medical Reimbursement Taxable are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and passions. Their access and versatility makes them an invaluable addition to both professional and personal life. Explore the plethora of Is Medical Reimbursement Taxable today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can print and download these documents for free.

-

Do I have the right to use free printouts for commercial usage?

- It depends on the specific conditions of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables may be subject to restrictions in use. You should read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home with a printer or visit an area print shop for better quality prints.

-

What software do I require to open Is Medical Reimbursement Taxable?

- Many printables are offered in PDF format, which can be opened using free programs like Adobe Reader.

Is Employee Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

Check more sample of Is Medical Reimbursement Taxable below

What Is Healthcare Reimbursement Insurance Noon

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Is Health Insurance Reimbursement Taxable

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Is Work From Home Reimbursement Taxable

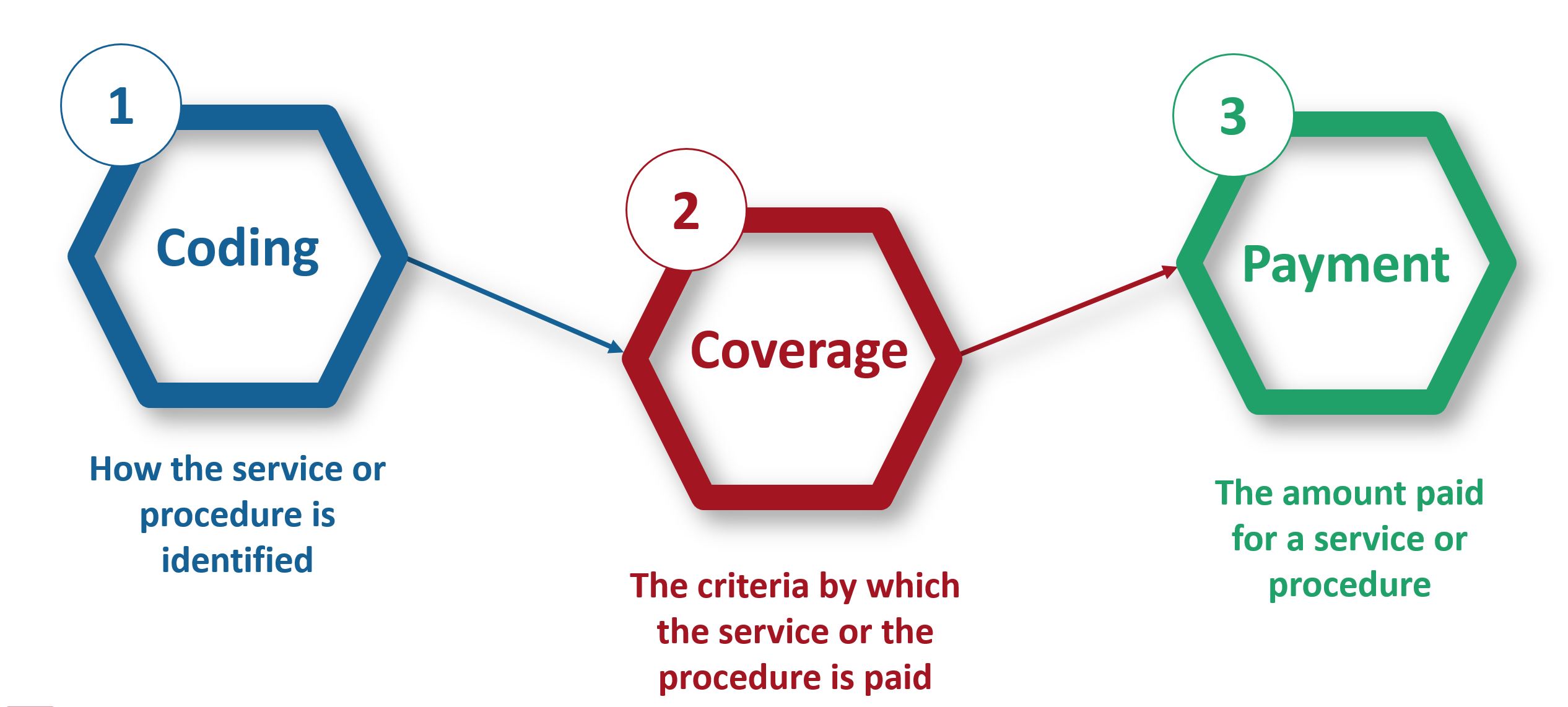

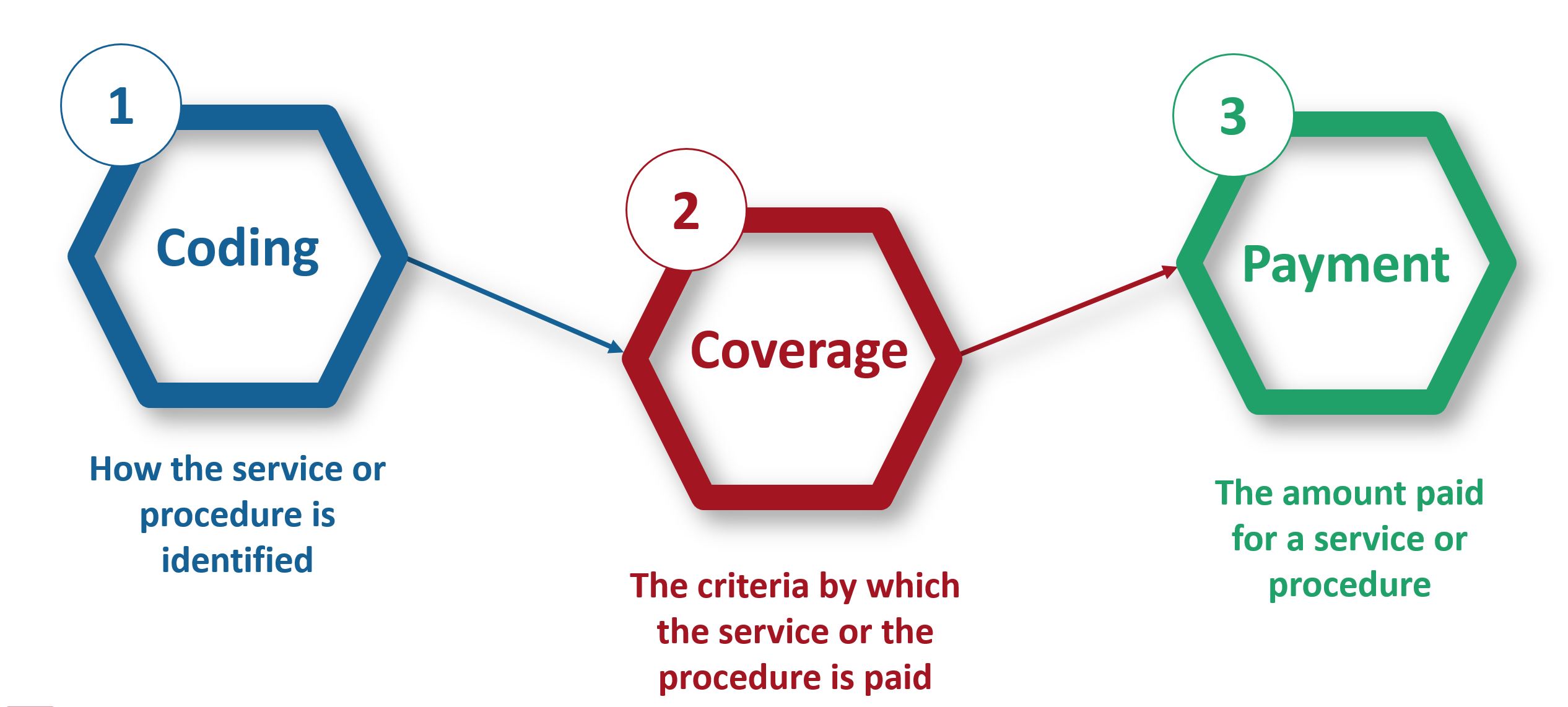

Understanding Reimbursement For Medical Devices Coding Coverage

https://taxguru.in/income-tax/taxability-medical...

In case of salaried person who is provided with medical allowance the whole amount will be taxable The medical facility in India provided to the employee or his dependent relative i e children spouse brothers sister and parents by his employer will not be chargeable to tax to the extent of the following

https://learn.quicko.com/medical-allowance-reimbursement

Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical bills In this case the excess amount is added to the head salary of the employee at the time of filing ITR on the Income Tax Portal

In case of salaried person who is provided with medical allowance the whole amount will be taxable The medical facility in India provided to the employee or his dependent relative i e children spouse brothers sister and parents by his employer will not be chargeable to tax to the extent of the following

Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical bills In this case the excess amount is added to the head salary of the employee at the time of filing ITR on the Income Tax Portal

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Is Work From Home Reimbursement Taxable

Understanding Reimbursement For Medical Devices Coding Coverage

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

What Is Pre Tax Commuter Benefit